As an emerging transportation tool in the logistics industry, new energy VANs (light buses and microbus series) are experiencing steadily increasing market penetration. To maintain growth amid fierce competition, these vehicles must not only consolidate their existing applications but also explore new scenarios while deepening integration with physical logistics operations—a necessity dictated by market evolution and future development trends.

Currently categorized as "small" or "medium" vans within logistics, these vehicles divide into two primary types: dedicated logistics models (with opaque windows) and dual-purpose passenger-cargo models (with transparent windows). The latter's operational flexibility has particularly attracted logistics users, creating some market overlap between the categories. Industry consensus now holds that new energy light trucks suit scheduled transportation (like contract logistics), while VANs excel in unscheduled operations (such as freight platforms).

This perception stems from two factors: freight platforms' visible impact on VAN sales, and the growing market presence of these vehicles. However, such categorization carries limitations—given that scheduled logistics dominate 85% of the market, VAN brands must expand beyond their unscheduled logistics identity to establish comprehensive market positioning.

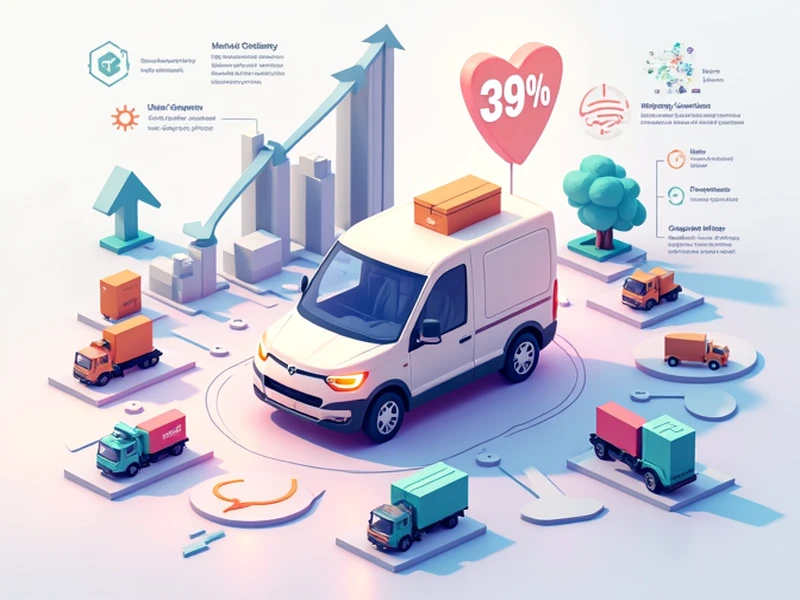

Understanding current developments reveals both opportunities and challenges. New energy VANs boast a remarkable 39% market penetration from January to October 2024, leading all commercial new energy vehicles—far surpassing light trucks (15%) and heavy trucks (12%). Yet this success comes with rising default rates and accident risks.

Financial data indicates higher default rates among VANs, attributable to market saturation with inexperienced drivers unfamiliar with logistics operations. Similarly, accident rates climb due to novice operators, platform-based rush-order models, and complex urban environments. Addressing these issues requires deeper collaboration with established logistics entities—only through participation from experienced fleet managers can safety metrics improve.

Having progressed through policy-driven, operation-driven, platform-driven, and channel-driven development phases, new energy VANs now face stagnant demand growth despite policy support. Identifying new battlefields becomes imperative.

Three promising frontiers emerge:

First, last-mile store deliveries—including supermarkets, community groups, and fresh produce—offer substantial potential. As B2B delivery platforms specialize and expand, VANs benefit from integrated logistics sources, cargo-friendly designs, and real-time management systems that streamline operations.

Second, commercial distribution networks centered around trade markets could leverage VAN-based systems for rapid regional coverage. This approach balances economy and efficiency, particularly in lower-tier markets.

Finally, regional express networks struggle with final-door delivery—a pain point VANs can alleviate. Their enclosed compartments reduce loss risks, while flexible procurement options and system integration help lower operational costs while meeting customer needs.