In today's complex and uncertain global dry bulk shipping market, we can feel both the pressure and opportunities it presents. For many industry participants, this is not just a numbers game but an emotional journey. In this context, it might be worthwhile to pause, take a deep breath, and reflect on the industry's future direction and how to better adapt to upcoming changes.

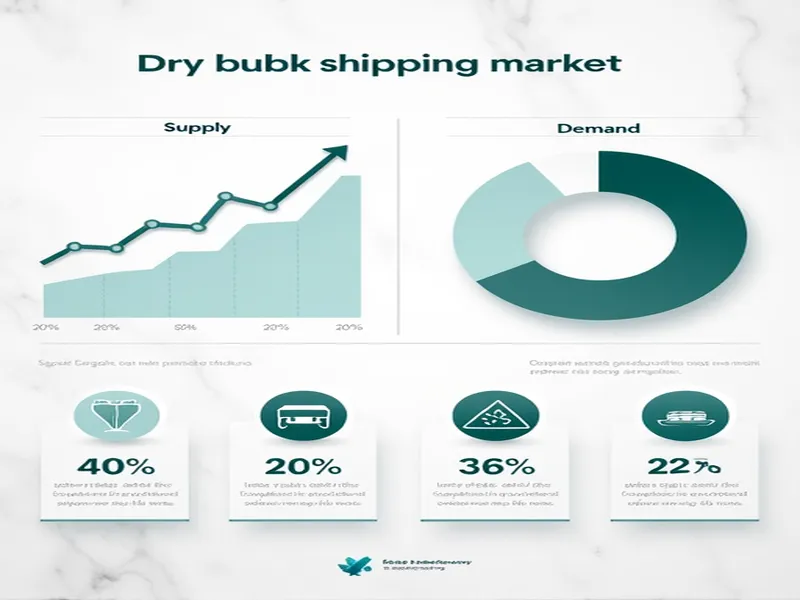

First, it's noteworthy that global dry bulk shipping capacity has grown rapidly in recent years, while market demand hasn't kept pace. This supply-demand imbalance, like a tangled skein of thread, often leaves us feeling confused and anxious. For shipowners, cargo owners, and crew members, prolonged low freight rates and unstable market conditions affect not just their economic interests but also their psychological well-being. So how can we maintain confidence and hope in such an environment?

We can start by examining current market conditions for positive signals. Despite the growing global dry bulk fleet, port congestion and increased coastal trade in China have brought some glimmers of hope. Data shows that 263 dry bulk ships are currently stranded at loading and unloading ports worldwide, representing about 5.5% of global dry bulk capacity. These numbers reflect not just supply-demand dynamics but the interplay of macroeconomic factors, trade policies, and fuel price fluctuations. One can imagine the frustration felt by shipowners and crews caught in this port congestion.

To understand this situation, picture a typical port on a busy day: ships moving methodically through choppy waters, only to have their rhythm disrupted by sudden changes in international conditions or environmental factors. The waiting, bureaucratic procedures, and resource shortages exhaust every participant. This is particularly evident with Capesize and Panamax vessels, where prolonged waits and unforeseen losses are common. While such examples can be disheartening, these short-term disruptions make market adjustments both more urgent and inevitable.

When facing these challenges, we might consider psychological approaches to coping. Basic cognitive behavioral therapy techniques can help reframe negative emotions and thoughts. For instance, time spent waiting in port could be viewed not as wasted but as an opportunity for self-reflection and future planning. Shipowners and crews might use this time to reassess their market position, study industry trends, or pursue personal development like improving language skills. Such positive thinking can help us adapt more quickly when the market recovers.

Meanwhile, while port congestion creates short-term pressure for shipowners, it also provides some protection for rental rates. In situations of supply-demand imbalance, market rates may rise. Shipowners should monitor this trend to determine optimal times to sell or lease vessels for maximum economic benefit. Maintaining flexibility is crucial here. By adapting to changes and reasonably predicting future market directions, we can gain a competitive edge.

On the other side of the global dry bulk market, China's coastal trade recovery is making demand increasingly important. Quarterly demand of about 200 million tons represents nearly 6% of total global dry bulk capacity. This strong positive feedback enhances market resilience and offers hope to participants. Shipowners and charterers should respond actively to this potential by adjusting their strategies accordingly.

Psychologically, this is also an encouraging moment. We can boost confidence through self-affirmation—envisioning future market prospects and personal goals to motivate more active engagement. Market recovery may not happen overnight, but persistent effort will help us find opportunities. Maintaining a positive mindset is particularly important for effective emotion management and adaptation to uncertainty.

Additionally, while this year's iron ore imports may disappoint, coal transport demand remains promising. Growing needs for thermal and coking coal are injecting vitality into the dry bulk market—a noteworthy positive signal. When certain market segments perform well, others may benefit indirectly.

From a psychological perspective, these capital market fluctuations are natural industry characteristics, much like life's ups and downs filled with opportunities and challenges. Mature participants learn to accept these fluctuations while spotting opportunities within them. Market cycles aren't linear but follow their own rhythm. Our task is to adjust our mindset, meet challenges, and grow through each fluctuation.

However, regardless of market changes, accumulated orders continue affecting market stability. Forecasts suggest a 40% reduction in new ship deliveries is key to maintaining efficient global dry bulk capacity utilization. This makes us wonder how well supply can match demand. Resource integration and optimization become particularly important here, requiring shipowners and operators to act cautiously with well-reasoned strategies for emerging challenges.

As participants, beyond monitoring market data, we must focus on internal growth. In this competitive era, maintaining good psychological health is ultimately the foundation for market survival and development. Shipowners and crews are already engaged in a form of self-cultivation through market fluctuations—a process that will enhance their resilience and adaptability for future markets.

Finally, I hope all participants in this field can collaborate, share experiences, and face challenges together while working toward supply-demand balance. The future dry bulk shipping market will undoubtedly grow through transformation; our role is to maintain optimism, seize opportunities, and achieve steady development for both ourselves and the industry.