National Bank of Commerce SWIFT Code Aids Crossborder Payments

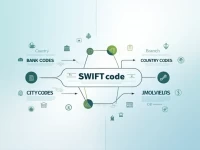

This article explores the composition of the SWIFT/BIC code for NATIONAL BANK OF COMMERCE, THE, and highlights its significance in international remittance. Additionally, it introduces the advantages of Xe remittance services, along with the transparency of exchange rates and fees, providing users with efficient and convenient cross-border payment solutions.