In the complex world of international trade, customs clearance procedures serve as a bridge to successful and smooth transactions. Each component of this bridge ensures goods can cross national borders efficiently, allowing businesses to operate seamlessly in global markets. However, this process often causes confusion, anxiety, and stress for many companies. Understanding and mastering each step of customs clearance is therefore crucial—it alleviates concerns and builds confidence.

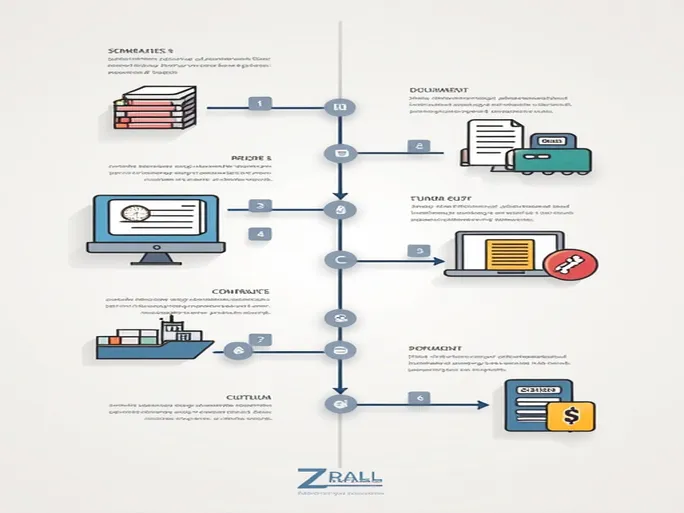

Step 1: Document Preparation

The first step in customs clearance involves preparing all relevant documentation. This process resembles preparing for an important presentation. You'll need to carefully organize foreign trade contracts, commercial invoices, packing lists, and bills of lading. These documents aren't just legal requirements—they're essential for smooth clearance. Accuracy is paramount at this stage, as even minor errors can cause delays or unnecessary fines. Stay calm, double-check every document, and ensure all information is correct.

Step 2: Creating the Customs Draft

Next, confidently prepare the customs draft manually, referencing relevant customs information. This draft serves as a detailed transaction record that will form the basis for electronic declaration. When filling in information, imagine you're creating a detailed itinerary for an upcoming business trip. Any omissions or mistakes here could impact future declaration processes, so approach this step with patience.

Step 3: Data Entry and Review

Your customs broker will then input the draft information into the QP system to generate a customs review form. This stage feels like a rigorous test—your information undergoes meticulous scrutiny. While anxiety might surface during this process, remember it's all about ensuring accuracy. Only after repeated verification can the customs agent proceed to the next step.

Step 4: Electronic Declaration

After approval, the customs agent logs into the electronic port to submit declaration data. This process is typically quick and efficient, though it comes with anticipation and nervousness. When submission is complete, you'll feel a wave of relief—your important declaration data has been successfully submitted. At this point, imagine your efforts paying off as you await customs feedback.

Step 5: Customs Review and Acceptance

Following submission, customs authorities examine the declaration information. You might feel tense during this waiting period, but remember—this standard procedure protects national economic security. When customs confirms everything and returns the data, you can breathe easily, knowing your efforts have borne fruit.

Step 6: Generating and Printing the Declaration Form

With the export customs declaration form obtained, you can print three copies from the QP system. This moment brings tangible achievement. You'll then need to verify the form's accuracy again before signing and stamping it with the customs seal. Through this procedure, you'll feel actively involved in every step.

Step 7: Submission and On-site Declaration

When submitting documents to customs for on-site declaration, nervousness may return. Face-to-face declarations make many businesses uneasy, but remember—you've prepared thoroughly. Once customs confirms the declaration's validity and accepts it, you've taken another step toward success.

Step 8: Tax Assessment and Payment

If the declaration meets requirements, customs issues a tax notice to the agent. This payment stage might cause slight apprehension, but remember—taxes are a necessary responsibility of compliant operations. Follow the notice's instructions to pay duties at the designated bank. Imagine yourself walking into the bank to fulfill this important obligation, filled with optimism for the future.

Step 9: Tax Verification and On-site Clearance

After tax verification, the agent submits the notice to customs for on-site clearance. When cleared, you'll feel tremendous relief. After both system and manual reviews, your goods are just one step from release.

Step 10: Inspection and Goods Release

In some cases, customs inspects the goods. Don't worry excessively—this safeguards security. If customs raises no concerns, you can collect your goods and complete the clearance process. At this moment, you'll experience unparalleled satisfaction: through your dedication, your international shipment has reached its destination successfully.

Each customs clearance step represents a journey with both challenges and rewards. We hope this guide boosts your confidence, reduces stress, and helps you complete every clearance process smoothly, paving the way for successful international trade.