Chapter 1: Customs Duty Exemption Policies and Their Definitions

Today we will thoroughly examine the crucial topic of customs duty exemption policies in import-export operations. These policies represent more than just terminology—they embody the essential legal frameworks governing cross-border trade. By understanding the classification of duty collection and exemption regulations for imported and exported goods, we can effectively navigate customs policies.

This classification system serves as the foundation for automated customs declaration systems and EDI clearance systems, while also providing raw data for customs tariff databases. Mastering this knowledge will enable more accurate duty cost forecasting and improved trade efficiency.

Chapter 2: Classification of Duty Exemption Policies

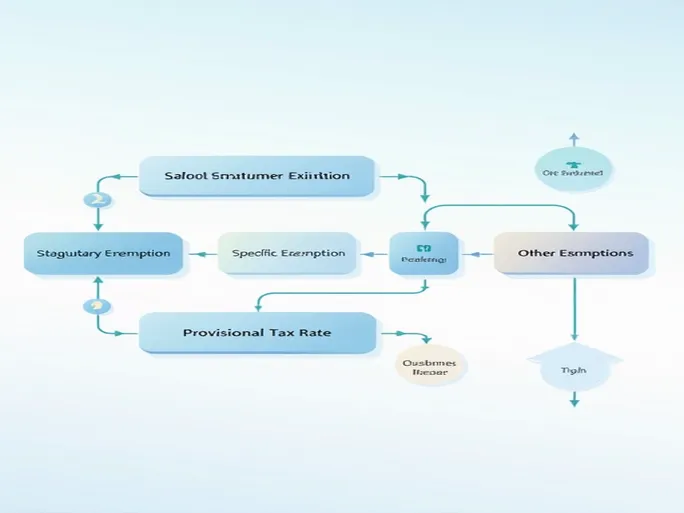

Customs duty exemption policies are primarily categorized into five types. First is statutory taxation, where customs levies duties on goods according to legal requirements. Second is statutory duty exemption, where certain goods may qualify for exemptions under specific legal provisions. Third is special duty exemption—targeted preferential policies for particular products or enterprises meeting specific conditions.

Additionally, there's "other exemptions" for special circumstances, and provisional tariff rates applied temporarily to certain goods during specific periods.

Special duty exemptions can be further divided into four subcategories, demonstrating the flexibility of customs policies: regional tax policies affecting cross-border transaction costs; purpose-based policies (e.g., for medical supplies); trade nature-based policies for evaluating different transaction types; and enterprise nature/funding source policies offering exemptions to qualified entities.

Chapter 3: Structure of Duty Exemption Codes

These classifications translate into practical operations through three-digit codes: the first digit indicates the category, while the second and third denote specific exemption items. For example, code 101 represents general taxation for imported/exported goods.

Understanding these code structures is essential for customs declaration processes, enabling clear identification of applicable tax treatments.

Chapter 4: General Taxation for Imported/Exported Goods

General taxation (code 101) applies to standard trade goods under China's Customs Law, subject to tariffs, VAT, and other taxes. This category covers most products with straightforward tax policies, facilitating cost estimation and planning.

Chapter 5: Duty-Free Imported Materials for Foreign Aid

Foreign aid materials refer to gratis assistance or donations from foreign governments and international organizations (excluding commercial gifts or personal donations), typically governed by bilateral agreements. Code 201 applies to UN-provided aid materials, while China's outward assistance also falls under this category.

In today's globalized economy, participation in foreign aid enhances national reputation while creating new cooperative opportunities for enterprises.

In summary, customs duty exemption policies significantly impact business costs and market competitiveness. Understanding these details enables better strategic planning, resource optimization, and operational efficiency in international trade.