In today's increasingly frequent global trade environment, customs clearance serves as the core process for goods crossing borders and is crucial for businesses. Only through compliant customs procedures can companies ensure smooth transportation of goods, reduce trade risks, and maximize profits.

Have you ever been frustrated by complicated customs procedures? Have you felt overwhelmed by complex customs policies? Don't worry! This article will provide a detailed breakdown of export and import customs clearance processes, offering practical advice for each step to help you navigate international trade with confidence.

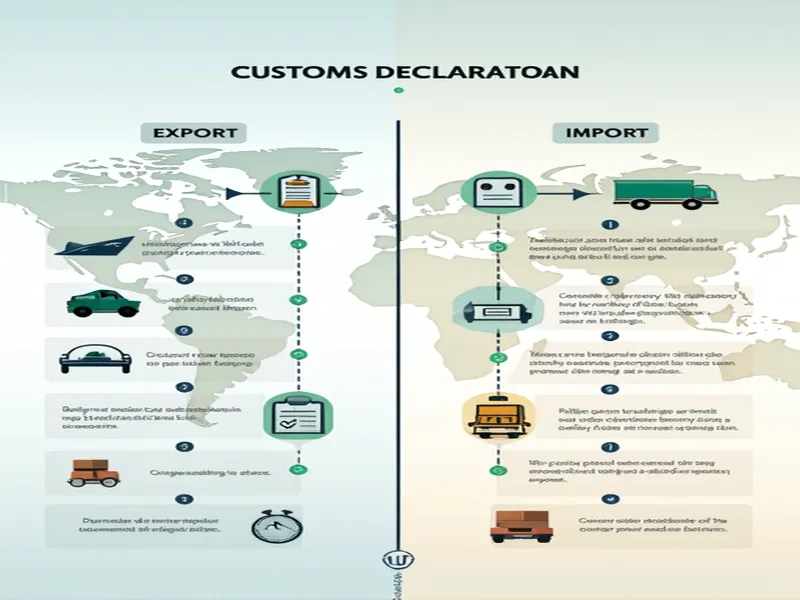

I. Detailed Analysis of Export Customs Clearance Process

1. Signing the Contract — The First Step in Trade

Before initiating export customs clearance procedures, you must first sign an export contract with your foreign buyer. At this stage, you need to clearly define product categories, quantities, and prices, while paying attention to export-related clauses in the contract. These may include export licenses, quality standards, delivery deadlines, and other terms to ensure clear responsibilities and obligations for both parties, laying a solid foundation for subsequent customs procedures.

2. Arranging Transportation — Seamless Logistics Connection

After signing the contract, you need to consider logistics. Find an experienced freight forwarding company that can provide one-stop services including customs clearance, ensuring smooth transportation from production site to port. When selecting a freight forwarder, be sure to verify their qualifications and market reputation to avoid last-minute problems.

3. Preparing Customs Documentation — A Critical Step

During transportation, you need to prepare a series of necessary customs documents, including but not limited to foreign exchange verification forms, export contracts, commercial invoices, packing lists, and customs power of attorney. These documents directly affect the speed of clearance and whether goods can be released smoothly.

4. Goods Arrive at Export Port — Entering the Supervision Period

When goods arrive at the export port, you officially enter the customs supervision phase. All containers must undergo customs inspection and recording to ensure compliance with export regulations. At this stage, maintaining composure and accurately handling each supervision requirement becomes particularly important.

5. System Export Declaration — The Importance of Online Operations

After containers enter the port yard, you need to declare through the customs electronic system. The customs broker will submit electronic declarations based on detailed cargo information. Data accuracy is particularly crucial at this stage, as customs may conduct random checks.

6. Submitting Documents — Ensuring Compliance

Once electronic declaration is approved, you need to submit release documents and related paperwork to customs. Customs officers will review your documentation; if complete and compliant, they will confirm release. At this point, you might be asked to submit additional documents—prompt response is key.

7. Loading and Export — The Final Step

After customs release, you will receive all export documents for the goods. Subsequently, goods will be loaded according to the shipping schedule. After vessel departure, you can request the shipping agent to print foreign exchange verification and tax refund documents, completing the process.

II. In-depth Analysis of Import Customs Clearance Process

Compared to exports, import customs clearance involves equally complex procedures. Below we detail each step of import customs clearance operations.

1. Submission of Declaration — The Key to Quick Response

The first step in import customs clearance is submitting relevant declaration documents to customs, including bills of lading, packing lists, invoices, etc. Ensure completeness and accuracy of all documents—this is the prerequisite for customs approval.

2. Document Review — Meticulous Requirements

When reviewing your documents, customs will verify information about imported goods, including tax rates, supervision requirements, and compliance with national standards. Patience is necessary during this stage, as review periods may vary.

3. Inspection and Taxation — A Process of Rational Analysis

If customs deems it necessary, you may need to cooperate with goods inspection to confirm actual conditions and attributes of the cargo. During this period, pay close attention to customs notifications to avoid missing inspection times.

4. Completing Inspection Procedures — Quality Assurance

After passing inspection, you need to complete relevant procedures at the inspection hall. Only after completing all inspections can goods be collected, ensuring compliance with quality and safety supervision standards.

5. Clearing Fees — The Importance of Advance Planning

Settle all relevant fees at the port hall to obtain customs release documents, then notify the corresponding yard for cargo pickup. At this stage, ensure transparency and compliance of all fees to avoid subsequent disputes.

6. Cargo Collection — The Final Step

After completing all procedures, you can collect goods at the designated location. At this point, check cargo condition and quantity against expectations to avoid additional losses due to oversight.

III. Summary and Outlook

Through the detailed analysis of export and import customs clearance processes above, you should now deeply understand the importance and complexity of customs clearance in international trade. Staying updated on customs policies and understanding changes in trade regulations will provide crucial protection for smooth business operations.

In your international trade journey, mastering these processes can not only save time costs but also enhance market competitiveness and achieve greater economic benefits.

Looking ahead, as the global economic landscape develops and changes, customs processes and related regulations will continue to evolve. In this context, maintaining learning and adaptability becomes particularly important. Through continuous experience accumulation and knowledge expansion, you will be able to navigate the international trade stage with ease, embracing greater challenges and opportunities.

We hope this article provides substantive help for your trade operations, making your international trade journey smoother and more successful!