In today's globalized economy, financial transactions have become an indispensable part of daily life. Whether exchanging currency for international travel or transferring funds to family and friends abroad, every transaction relies on the support of banking systems. Ensuring that funds reach their destination securely and efficiently is a top priority, and the International Bank Account Number (IBAN) plays a pivotal role in achieving this goal.

What Is an IBAN?

The International Bank Account Number (IBAN) is a standardized format used to identify bank accounts internationally. Composed of a series of letters and numbers, its primary purpose is to facilitate secure and efficient cross-border transactions. The International Organization for Standardization (ISO) mandates that all participating countries adhere to this format. The information embedded in an IBAN enables banks to quickly and accurately identify accounts, minimizing errors.

Structure of an IBAN

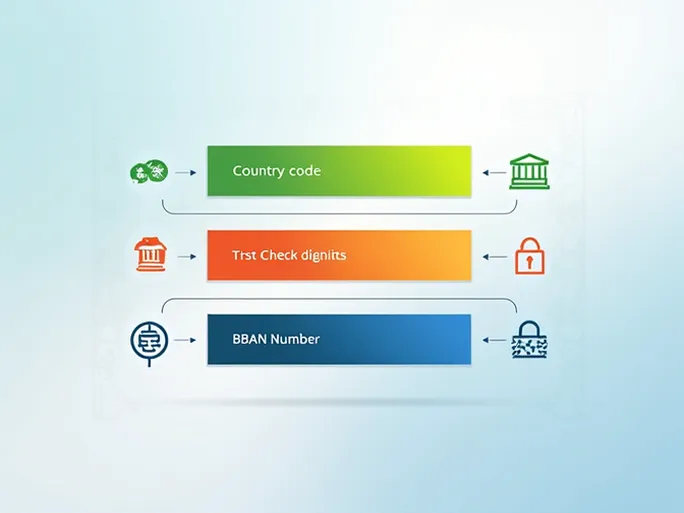

An IBAN consists of several distinct components, each serving a specific function. For example, the IBAN for Bosnia and Herzegovina includes the following parts:

- Country Code: The first two letters represent the country initiating the transaction (e.g., BA for Bosnia and Herzegovina). This code is critical for identifying the country involved in the transaction.

- Check Digits: The next two digits validate the IBAN's accuracy (e.g., 39 for Bosnia and Herzegovina). Generated through a specific algorithm, these digits help prevent errors during transfers.

- Basic Bank Account Number (BBAN): The remaining characters (e.g., 1290 0794 0102 8494) include the bank identifier, branch code, and unique account number. This section provides detailed information for processing transactions.

IBAN lengths vary by country, typically ranging from 15 to 34 characters. Despite variations, the standardized format ensures global recognition and streamlines banking operations.

The Importance of IBAN in International Finance

IBANs are essential for ensuring accurate cross-border fund transfers. While many banks worldwide have adopted the IBAN system, not all regions use it universally. Providing the correct IBAN is crucial for successful transactions.

- Preventing Errors: An accurate IBAN ensures funds reach the intended account. Incorrect IBANs may redirect payments to invalid accounts, complicating recovery efforts.

- Reducing Fees: Errors or missing IBANs can result in failed transactions and additional charges. Standardized IBANs minimize such issues.

- Enhancing Security: Each IBAN is unique, enabling precise tracking of funds and early detection of suspicious activity.

- Facilitating Global Trade: As international commerce grows, IBANs simplify transactions by eliminating ambiguities and disputes.

How to Find Your IBAN

Locating your IBAN is straightforward through the following methods:

- Online Banking: Most banks display IBANs in account information sections.

- Bank Statements: IBANs are often printed on paper statements.

- Customer Service: Contact your bank directly for assistance.

Common Use Cases for IBAN

IBANs are widely used in scenarios such as:

- International money transfers

- Payroll for multinational employees

- Tuition payments for students abroad

- Business transactions with international suppliers

Global Adoption of IBAN

While IBAN is prevalent in Europe, its adoption varies elsewhere. Some countries in Africa, Asia-Pacific, and the Americas still rely on traditional account numbering systems. Verifying banking requirements before initiating transfers is advisable.

Frequently Asked Questions

Can IBAN replace SWIFT codes? No. IBAN identifies bank accounts, while SWIFT codes identify banks. Both are often required for international transfers.

Are IBAN formats publicly available? Yes. ISO and national bank websites provide country-specific IBAN structures.

Do IBANs change? Typically, no. However, bank mergers or restructuring may necessitate updates.

Conclusion

IBANs are indispensable in modern global finance. Whether for personal or business transactions, their accurate use safeguards funds and ensures seamless cross-border payments. Verifying IBAN details before initiating transfers is a critical step in securing international financial operations.