In today's globalized financial landscape, international money transfers have become indispensable for both individuals and businesses. Amid this complex environment, the International Bank Account Number (IBAN) has emerged as a crucial tool for efficient and secure cross-border transactions. IBAN not only enhances the speed and accuracy of bank transactions but also provides customers with greater financial security.

What Is an International Bank Account Number (IBAN)?

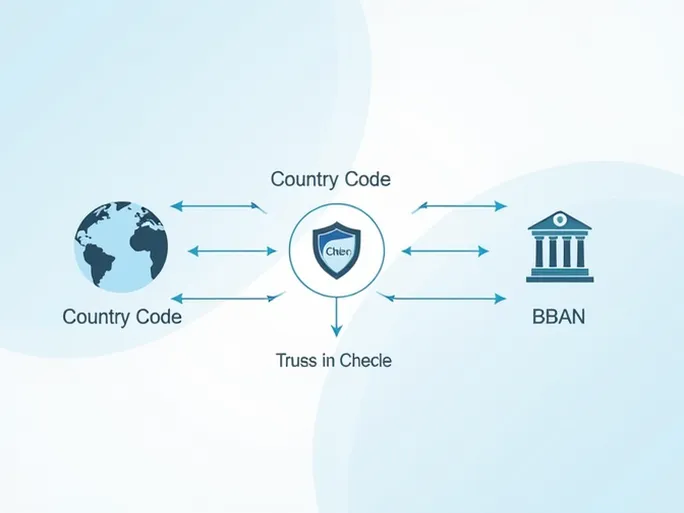

The International Bank Account Number, or IBAN, is a standardized account number designed to minimize errors in international payments. Typically consisting of 24 to 34 alphanumeric characters, an IBAN includes a country code, check digits, and a Basic Bank Account Number (BBAN). This structured format enables banks to quickly validate account details during cross-border transfers, significantly improving processing efficiency.

The IBAN structure comprises three key components:

- Country code (2 letters): A two-letter identifier representing the account's country (e.g., LU for Luxembourg, DE for Germany).

- Check digits (2 numbers): A validation mechanism to ensure the IBAN's authenticity.

- Basic Bank Account Number (BBAN): Contains bank-specific and account holder information, with formats varying by country.

Example IBAN: LU28 0019 4006 4475 0000

(Where "LU" is the country code, "28" are check digits, and the remaining numbers constitute the BBAN)

Why IBAN Matters in Global Transactions

The implementation of IBAN has addressed several challenges in international payments:

- Accuracy: The standardized format dramatically reduces input errors, creating a global identification system for bank accounts.

- Speed: Banks can process transactions faster when identifying accounts through IBAN.

- Security: The structured design helps prevent fraud, with anti-fraud measures more effectively applied to IBAN transactions.

- Cost efficiency: Fewer processing errors translate to lower bank fees for customers.

- Global standardization: IBAN has become the default for international transfers in many countries, facilitating smoother financial operations worldwide.

How to Obtain an IBAN

Accessing your IBAN is typically straightforward through these methods:

- Online banking: Most banks display IBAN information within digital account details or settings.

- Paper statements: Traditional bank statements often include the IBAN in account information sections.

- Bank inquiry: Customers can contact their bank's customer service for IBAN information.

- IBAN generators: Some online tools can calculate IBANs from basic account details, though users should verify the tool's reliability.

The Role of IBAN in International Transfers

When initiating cross-border payments, providing the correct IBAN is critical. The standard process involves:

- Transfer initiation: The sender provides recipient details including name, address, and IBAN through digital or in-person banking channels.

- Bank validation: The sending bank verifies the IBAN's format and validity before processing.

- Transaction processing: Validated transfers proceed through international systems like SWIFT.

- Confirmation: Recipients receive notification upon successful fund receipt.

Conclusion

As international transactions continue to grow in volume and complexity, understanding and properly using IBANs has become essential for both individuals and businesses. This standardized system not only streamlines global money movement but also enhances transaction security. Always verify IBAN details before initiating transfers to ensure smooth financial operations across borders.

Frequently Asked Questions

What happens if I enter an incorrect IBAN?

Funds may be returned or, in worse cases, transferred to the wrong account. Banks often charge fees for erroneous transactions.

Do all countries use the same IBAN format?

No. While European IBANs typically contain 20-34 characters, some countries like the United States don't use the IBAN system.

How often does my IBAN change?

IBANs generally remain constant unless you open new accounts or change banks.

Is IBAN universally accepted?

Many but not all countries use IBAN. Some still rely on traditional account identification methods.

Can I use IBAN for non-IBAN countries?

Transfers to non-IBAN countries may require alternative information like SWIFT/BIC codes instead of or in addition to account numbers.