The International Bank Account Number (IBAN) is a critical innovation in modern banking systems, simplifying cross-border payments and reducing the risk of errors. As the global economy continues to evolve, international transactions between businesses and individuals have become increasingly frequent, making secure and efficient payment methods essential. The IBAN was created to address this need, ensuring that funds can be transferred quickly and securely, regardless of location, with the right information and tools.

The Historical Context of IBAN

The history of the IBAN dates back to the 1970s. At that time, banks across Europe faced complexities in cross-border payments and the loss of funds due to errors in information transmission. To address this challenge, the International Organization for Standardization (ISO) collaborated with banks worldwide to establish the IBAN standard, making international banking transactions more efficient. By the early 1980s, the IBAN was formally introduced and gradually adopted by multiple countries. Over time, an increasing number of nations began implementing this system, making the use of IBAN a standard practice in international transfers.

The Components of an IBAN

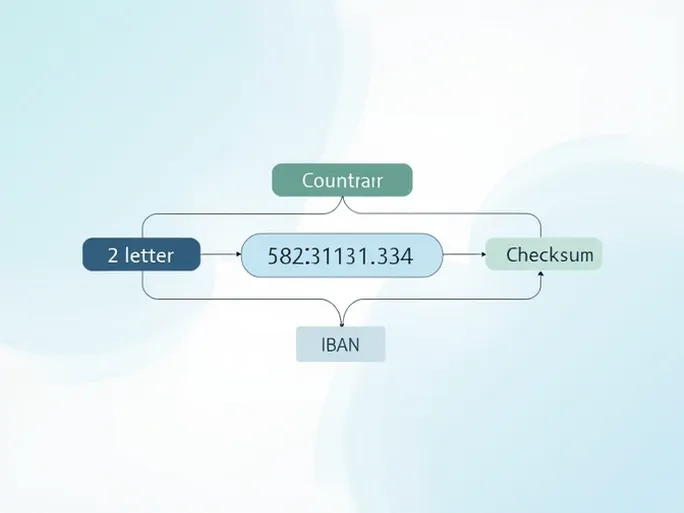

An IBAN is a combination of letters and numbers, typically ranging from 15 to 34 characters, depending on the country's regulations. For example, Tunisia's IBAN format is TN59 1000 6035 1835 9847 8831 . Below are the key components of an IBAN:

- ISO Country Code: The first two letters represent the country where the account is held. For Tunisia, this code is "TN."

- IBAN Check Digits: The next two digits are check digits used to validate the IBAN's accuracy. In the example above, the check digits are "59."

- Basic Bank Account Number (BBAN): The remaining characters form the BBAN, which contains details about the local bank and account. In Tunisia's IBAN, the BBAN is "1000 6035 1835 9847 8831."

The IBAN is designed to provide a standardized format, ensuring that banks across different countries can identify and process cross-border payments efficiently. This system minimizes the risk of funds being lost due to incorrect information.

The Importance of IBAN in International Transfers

International remittances involve multiple countries, banks, and legal frameworks, and the IBAN simplifies this process significantly. Below, we explore the critical role of IBAN in international transfers and the benefits it offers.

Reducing Errors

Using an IBAN for international transfers significantly reduces the risk of errors. Since the IBAN is a standardized format for identifying bank accounts, it minimizes the likelihood of funds being lost due to incorrect input. For example, without an IBAN, entering an incorrect account number could result in funds being sent to the wrong recipient, leading to lengthy recovery processes. With an IBAN, banks can quickly verify the accuracy of account details using the check digits.

Enhancing Payment Efficiency

The IBAN streamlines communication between banks, accelerating the processing of international transactions. Traditional cross-border transfers often require multiple verification steps, but the IBAN allows banks to identify account details directly, reducing intermediaries and speeding up the process. This is particularly beneficial for businesses and individuals who need to complete urgent transactions securely.

Global Acceptance

The IBAN is not limited to specific countries but is widely accepted across multiple nations. For individuals and businesses conducting frequent international transactions, understanding IBAN regulations facilitates seamless global payments. This universal applicability allows users to manage payments from anywhere in the world without navigating complex banking systems.

How to Locate and Use Your IBAN

Before initiating an international transfer, ensuring you have the correct IBAN is crucial. Below are some methods to find and verify your IBAN:

1. Online Banking

Most banks offer online services where you can log in to your account and locate your IBAN. Typically, this information is available in the account settings or details section. Some banks also list the IBAN on monthly statements.

2. Bank Statements

If you have a paper or electronic bank statement, your IBAN is usually displayed there. Banks clearly list essential details on statements to ensure account holders can access their information at any time.

3. Contact Customer Support

If you cannot find your IBAN or have concerns about its validity, contacting your bank's customer service is advisable. Representatives can assist in confirming your IBAN and addressing any questions.

Frequently Asked Questions

Users may have questions about IBAN usage. Below are some common queries and their answers:

1. How Does an IBAN Work?

An IBAN functions by providing a standardized method for identifying bank accounts. When initiating an international transfer, the sender provides the recipient's IBAN, allowing banks to accurately identify the destination account and securely transfer funds.

2. Who Uses an IBAN?

IBANs are primarily used for interbank international transfers, serving individuals, businesses, and anyone requiring cross-border payments. As global economic integration deepens, more individuals and corporations rely on IBANs to ensure transaction accuracy and security.

3. Why Do Some Countries Not Use IBANs?

Not all countries mandate the use of IBANs. Some nations have historically relied on their own transfer systems, while others may have banking infrastructures that do not yet support IBANs. However, international adoption of IBANs is growing, with many countries upgrading their systems to comply with global standards.

4. What Is a SWIFT/BIC Code?

A SWIFT/BIC code is a bank identifier used alongside the IBAN in international transfers. While the SWIFT code identifies the financial institution, the IBAN specifies the recipient's account. Together, they ensure secure and precise cross-border transactions.

5. What Are Check Digits?

Check digits are part of the IBAN used to validate its correctness. Calculated using a specific algorithm, these digits help prevent errors in fund transfers. Banks typically verify the check digits automatically during transactions, enhancing security.

Modern International Payment Platforms

With the rise of digital banking, numerous international payment platforms have emerged, offering faster, more convenient, and cost-effective alternatives to traditional banks. These platforms address common banking limitations, providing seamless cross-border payment solutions.

Key Advantages of Digital Payment Services

- Transparent Fees: Many platforms offer clear pricing without hidden charges.

- Competitive Exchange Rates: Digital services often provide better exchange rates, saving users money.

- Rapid Processing: Transactions can be completed within hours, unlike traditional bank transfers, which may take days.

- Global Coverage: Leading platforms support multiple currencies and serve numerous countries, catering to diverse user needs.

Conclusion

In an increasingly interconnected world, international payments have become indispensable. The IBAN provides a secure and reliable foundation for these transactions. Whether for personal remittances or corporate dealings, understanding and correctly using an IBAN saves time and mitigates risks. When selecting a payment service, exploring modern platforms can enhance efficiency and security. By leveraging IBANs and contemporary payment solutions, cross-border financial transactions become more accessible, enabling seamless global fund movement.