Have you ever felt anxious about making international money transfers, worrying that incomplete or incorrect information might lead to financial losses? Today, we examine an important tool that facilitates smooth cross-border transactions: the International Bank Account Number (IBAN).

The IBAN is a unique identifier comprising up to 34 alphanumeric characters, designed to help banks efficiently process global money transfers. By consolidating your local banking details into a concise string of characters, the IBAN enables quick identification of your account for both sending and receiving funds internationally.

Understanding the IBAN Structure

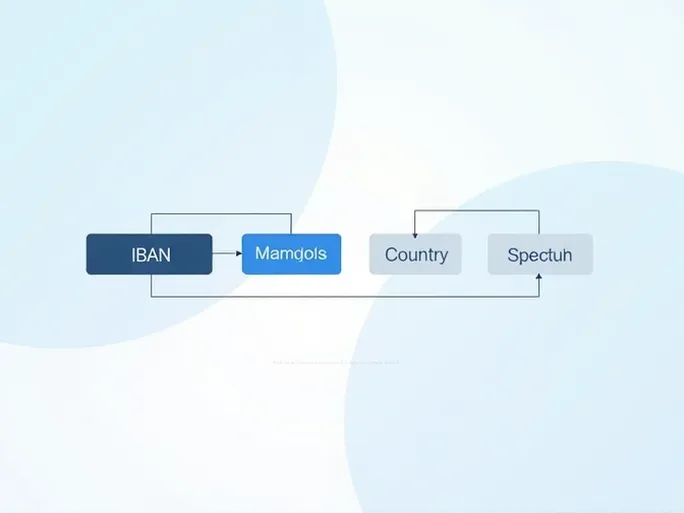

An IBAN consists of three distinct components:

- Country Code: Two letters identifying the country (e.g., "KZ" for Kazakhstan).

- Check Digits: Two numbers that validate the IBAN's authenticity (e.g., "86" for Kazakhstan).

- Basic Bank Account Number (BBAN): Contains domestic banking and account details.

For example, a Kazakhstani IBAN might appear as: KZ86 125K ZT50 0410 0100 , where:

- Bank Identifier: 125

- Account Number: KZT5004100100

For successful transactions, printed IBANs typically appear in groups of four characters, while electronic formats omit spaces. Accurate IBAN formatting is crucial—errors may result in failed transactions, additional fees, or funds being sent to incorrect accounts.

Locating Your IBAN

To find your IBAN, check your online banking portal or bank statements. Whether sending money abroad or receiving international payments, proper IBAN usage ensures secure transactions. Many European banks require IBANs for international transfers to guarantee prompt and accurate delivery of funds.

The Growing Adoption of IBAN

As more financial institutions worldwide implement the IBAN system, understanding its importance and proper use has become essential. However, not all countries use IBANs, so additional information may be required for certain international transfers. The IBAN system provides a secure and efficient method for managing cross-border payments, but only when used correctly can it minimize errors and processing delays.

For those with further questions about IBAN usage, comprehensive guides are available to help navigate international transactions. Mastering this financial tool can significantly streamline your global money transfers, whether you're sending funds or receiving payments from abroad.