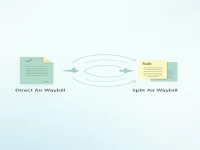

Understanding Direct Air Waybills Vs. Split Air Waybills

This article provides a detailed analysis of two types of air waybills: the direct waybill and the split waybill. It delineates their definitions, applicable scenarios, and functional differences. The direct waybill is primarily used when the shipper and consignee information is directly displayed, while the split waybill is utilized in complex freight forwarding operations, helping to simplify the customs clearance process. Understanding the differences between these two types of waybills will enhance the efficiency of foreign trade operations.