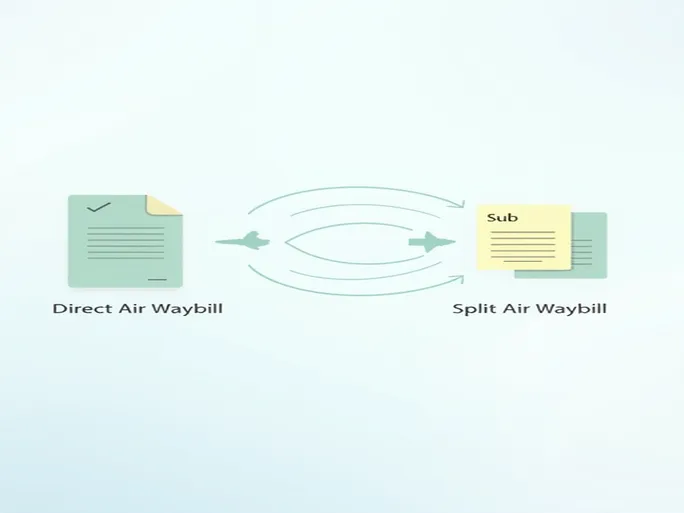

In the process of air freight exports, international trade professionals frequently encounter the terms "direct air waybill" and "split air waybill." Recognizing the distinction between these two documents is crucial for compliant operations and smooth customs clearance.

1. What Is a Direct Air Waybill?

A direct air waybill refers to a shipping document issued by an airline where the shipper field directly states the actual exporter (typically the cargo owner), and the consignee field shows the genuine importer at the destination. In this scenario, there's only one complete air waybill without any subsidiary documents.

2. What Is a Split Air Waybill?

A split air waybill arrangement is used in more complex shipping situations. Here, the airline-issued master air waybill lists the freight forwarder at the origin port as the shipper and the destination agent as the consignee, without revealing the actual trading parties' information. The originating forwarder then issues a house air waybill (HAWB) to the real shipper, containing the true consignee and shipper details. This process involves at least one master air waybill and one or more house air waybills. While the actual trading parties receive the HAWB, the master document remains exclusively for use between airlines and freight forwarders.

3. When Is a Split Air Waybill Necessary?

Split air waybills are typically employed when freight forwarders handle destination clearance. This approach streamlines customs procedures by designating the forwarder's local agent as the consignee on the master document, facilitating smoother clearance and subsequent cargo handling. By clearly understanding the definitions and applications of direct and split air waybills, trade professionals can implement more efficient shipping processes and minimize potential delays caused by information gaps.