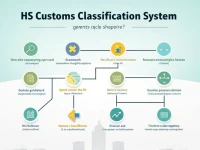

Threestep Guide to Accurate HS Code Classification

This article addresses the challenges of HS code classification. It summarizes the experience of seasoned classification specialists and proposes a three-step method: preliminary screening via keyword search, precise matching by consulting the tariff, and final confirmation by clarifying details. Through detailed examples, it helps businesses quickly and accurately identify commodity tariff numbers, avoiding customs clearance risks. This method aims to streamline the process and ensure compliance, ultimately benefiting businesses engaged in international trade.