New Trade Opportunities Emerge for Chestnuts Under HS Code 0802409000

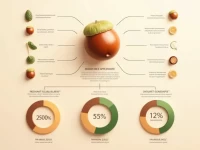

This article explores the customs code 0802409000 for other fresh or dried chestnuts, covering product information, tax rate policies, and regulatory requirements. It aims to assist traders in understanding market dynamics and the advantages of the product.