In today's increasingly globalized economy, international trade has become a vital link connecting nations through economic interdependence. At the heart of this system lies the need for standardized commodity classification, with the Harmonized System (HS) Code emerging as the universal language of global trade.

Among the various HS classifications, Chapter 71 holds particular significance as it governs the trade of precious metals including platinum, gold, silver, and their derivatives. These rare materials, valued for their unique physical and chemical properties, play crucial roles across modern industries from electronics to aerospace.

I. Structure and Key Classifications of HS Code 71

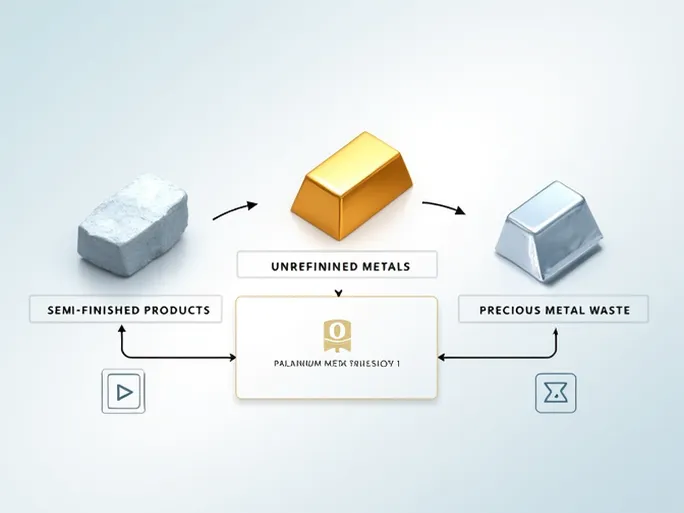

The HS Code 71 system categorizes precious metals based on their form and processing stage, creating distinct subcategories that shape international trade flows.

1. Unwrought or Powdered Precious Metals

This classification covers raw precious metals in their most basic forms, serving as essential industrial inputs:

- Platinum (HS Code 7110.11.00) : This ultra-rare metal dominates catalytic converter production and high-end jewelry manufacturing. With 0% export tax rebates globally, platinum's market dynamics closely track industrial demand and macroeconomic trends.

- Palladium (HS Code 7110.21.00) : The automotive industry's shift toward cleaner emissions has made palladium one of the most sought-after metals, particularly for catalytic converters in gasoline vehicles. Like platinum, it carries 0% export rebates.

- Rhodium (HS Code 7110.31.00) : Though traded in smaller volumes, rhodium's extreme price volatility makes it a critical metal for market watchers. Its primary use in automotive catalysts creates concentrated demand.

2. Semi-Manufactured Products

These partially processed materials bridge the gap between raw metals and finished goods:

- Platinum plates/sheets (HS Codes 7110.19.10/90) : Vital for medical devices and telecommunications equipment, these semi-finished products accelerate manufacturing processes while maintaining 0% export rebates.

- Palladium/Ruthenium semi-products (HS Codes 7110.29.10/7110.39.10) : These components prove indispensable in microelectronics, particularly for electrical contacts and precision instruments.

3. Precious Metal Ash

The recycling economy transforms industrial byproducts into valuable commodities:

- Silver ash (HS Code 7112.30.10) : Carrying a 13% export rebate, silver recovery from photographic waste and electronic scrap has become increasingly profitable as circular economy practices gain traction.

- Other precious metal ashes (HS Code 7112.30.90) : These materials maintain 0% rebates but offer significant recovery value for specialized refiners.

4. Scrap Materials

The secondary precious metals market thrives on efficient scrap processing:

- Gold scrap (HS Codes 7112.91.10/90) : Jewelry and electronic waste recycling has created a robust global market for gold recovery, with 0% export rebates applying across categories.

II. Global Trade Significance

As technological advancement drives unprecedented demand for precious metals, HS Code 71 products have become economic bellwethers.

1. Evolving Market Demand

The green energy transition has dramatically altered consumption patterns. Electric vehicle adoption requires substantial platinum-group metals for fuel cells and catalytic systems, while renewable energy infrastructure demands silver for photovoltaic cells.

2. Price Volatility Factors

Precious metal markets remain highly sensitive to:

- Central bank monetary policies

- Geopolitical instability

- Industrial production forecasts

- Currency fluctuations

3. Regulatory Considerations

Trade compliance has grown increasingly complex with:

- Stricter conflict mineral regulations

- Enhanced recycling mandates

- Customs valuation challenges

III. Future Outlook

The precious metals trade stands at an inflection point as technological innovation and sustainability concerns reshape the industry:

- Technology demand : 5G infrastructure, quantum computing, and space technologies will drive specialty metal requirements

- Circular economy : Urban mining and advanced recycling techniques may reduce primary production dependence

- Market transparency : Blockchain applications promise improved supply chain traceability

For businesses navigating this complex landscape, mastery of HS Code 71 classifications serves as both a competitive advantage and risk mitigation tool. As global trade networks evolve, understanding these precious metal classifications will remain fundamental to international commerce.