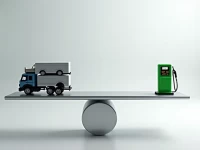

Rising Diesel Prices Drive Up Logistics Costs for Shippers

According to the latest data from FTR, a freight consulting firm, the Shipper Conditions Index (SCI) has fallen below zero for the first time since October 2022. Rising diesel prices are a major contributor, leading to increased freight rates and fuel surcharges, thus worsening the transportation environment for shippers. It is recommended that shippers optimize transportation routes, improve load factors, and choose appropriate transportation modes to cope with cost pressures.