Yapi Kredi Bankasi Simplifies International Transfers Via SWIFT

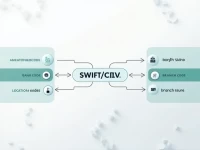

Understand the SWIFT/BIC code YAPITRISAUD of YAPI VE KREDI BANKASI A.S. to ensure your international transfers are smoother and safer. Familiarize yourself with the bank's code and related information to ensure funds reach the designated account accurately, helping you easily tackle cross-border payment challenges.