In today's globalized economy, cross-border transactions have become increasingly common, serving diverse needs such as international trade, personal remittances, and investments. In this context, banks play a pivotal role, and the SWIFT/BIC code has emerged as a critical tool for facilitating international wire transfers. For those needing to send funds to Danske Bank A/S in Finland, understanding its SWIFT/BIC code— DABAFIHHXXX —along with its structure and applications is essential to ensuring seamless transactions.

Understanding SWIFT/BIC Codes

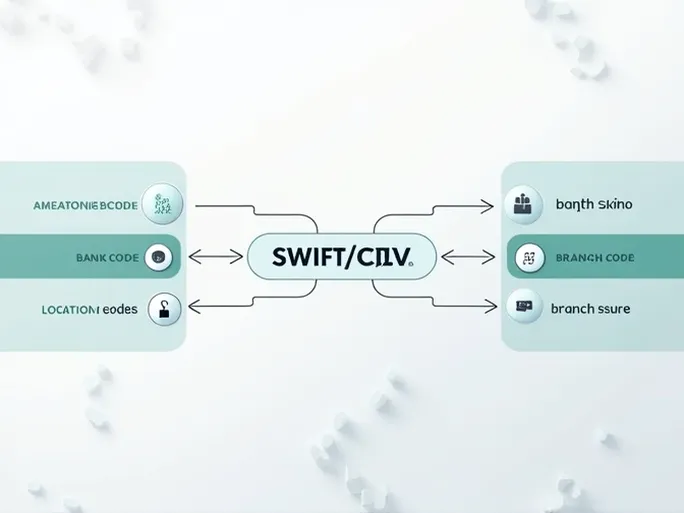

Founded in 1973, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) was established to provide a secure and reliable platform for international financial messaging. As global trade and financial activities expanded, SWIFT codes evolved into standardized identifiers for interbank transactions. Each SWIFT code typically consists of 8 to 11 characters, comprising a bank code, country code, location code, and optional branch code, ensuring precise routing of funds.

Breaking down Danske Bank A/S's SWIFT code DABAFIHHXXX :

- DABA identifies the bank, serving as the primary reference for Danske Bank A/S.

- FI is the country code, confirming the bank's location in Finland.

- HH represents the location code, specifying the city or branch.

- XXX denotes the branch or headquarters, ensuring funds reach the intended destination.

Danske Bank A/S: A Trusted Financial Institution

Headquartered in Denmark, Danske Bank A/S is one of the Nordic region's most influential financial institutions, with operations spanning Denmark, Finland, Sweden, and Norway. The bank offers a comprehensive suite of services, including personal banking, corporate finance, capital markets, and wealth management, making it a preferred choice for international clients.

With a strong commitment to digital transformation, Danske Bank A/S has enhanced its online and mobile banking platforms, providing customers with efficient and secure access to services such as savings, investments, and cross-border payments.

Key Considerations for Cross-Border Transfers

Beyond the SWIFT/BIC code, senders must ensure accurate bank details, including the recipient's address: Televisiokatu 1, Helsinki, FI-00075, Finland . Errors in this information can lead to delays or failed transactions.

Additional factors to consider include:

- Transaction fees: Costs vary across institutions, so comparing options can optimize savings.

- Exchange rates: Fluctuations may impact the final amount received.

- Processing times: Traditional transfers may take several business days.

The Future of Cross-Border Payments

Financial technology advancements are reshaping international transactions. Fintech companies now offer faster and more cost-effective alternatives to traditional banking systems. In response, institutions like Danske Bank A/S are innovating to remain competitive.

Emerging technologies like blockchain promise greater transparency, speed, and security in cross-border payments. While these systems have yet to replace SWIFT entirely, their potential to revolutionize the industry is undeniable.

Adhering to Global Financial Standards

Compliance with international financial standards is paramount for secure transactions. Staying informed about SWIFT/BIC codes and related protocols helps mitigate risks and ensures smooth operations. As financial markets grow increasingly complex, keeping abreast of regulatory updates and policy changes is equally critical.

Final Thoughts

When transferring funds to Danske Bank A/S in Finland, accuracy is non-negotiable. Verifying the SWIFT/BIC code DABAFIHHXXX and associated details safeguards your transaction. As financial landscapes evolve, leveraging reliable banking services and staying informed will remain key to successful cross-border transactions—whether for personal or business purposes.

Danske Bank A/S stands as a trusted partner in international finance, offering a seamless gateway for global transactions. Always double-check banking information before initiating transfers to ensure timely and accurate delivery of funds.