Deciphering the HS Codes for Cutting Tools and Blades

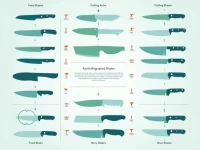

This article provides a detailed analysis of HS codes for cutting tools and blades, primarily falling under the category of 82.11. It focuses on the subdivision of various types of tools, including fixed blades, folding knives, and their blades, while emphasizing the importance of accurate classification to aid readers in understanding the key points of customs declaration.