In the realm of international trade, the classification and coding of goods is a crucial yet complex process. Among these classifications, knives with cutting blades and their HS Code 82.11 represent a particularly significant category. This classification doesn't just account for a knife's material, design, and function—it plays a pivotal role throughout the entire trade process. Today, we'll examine HS Code 82.11 in detail, exploring its specific contents and applications to provide deeper insight into this specialized field.

The Scope of HS Code 82.11

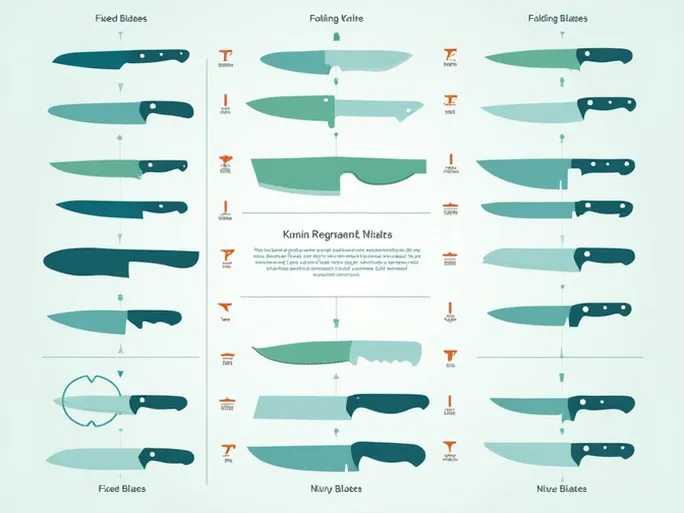

HS Code 82.11 primarily encompasses various types of knives, including both fixed-blade and folding knives. From everyday kitchen knives and survival knives to pocket folding knives, nearly all common cutting tools fall under this classification. For more precise trade management and statistical purposes, the 82.11 category is further divided into several subcategories:

- 8211100000 — Complete knife sets, such as comprehensive kitchen knife collections that typically include a main chef's knife, utility knives, and a knife block. These sets find widespread use in both household and commercial kitchens.

- 8211910000 — Table knives with fixed blades. These knives often combine functionality with aesthetic appeal, creating unique culinary artifacts that enjoy broad consumer popularity.

- 8211920000 — Other fixed-blade knives, including specialized tools like bottle openers or cutting implements. These knives typically serve specific professional purposes in particular industries.

- 8211930000 — Folding knives, encompassing various folding blade implements including Swiss Army knives. Their versatility and compact design make them particularly popular for outdoor activities, travel, and everyday carry.

- 8211940000 — Blades for knives. While the knife provides the tool, the blade's quality and design directly determine the implement's cutting performance and efficiency, making this a critical subcategory.

- 8211950000 — Handles made of base metals. The handle material affects not just a knife's weight and durability but also the user experience. High-quality handles can significantly enhance a knife's overall performance.

The Critical Importance of Accurate HS Classification

Precise classification under HS Code 82.11 carries significant implications for international trade. First and foremost, declaration accuracy directly impacts customs clearance efficiency. Misclassification can lead to cargo delays at customs, potentially resulting in unnecessary fines and logistical complications.

Moreover, correct coding facilitates accurate trade statistics. Customs authorities worldwide use this data for macroeconomic analysis, tracking import and export trends to inform policy decisions. Inaccurate business declarations can distort this data, potentially skewing industry-wide analyses.

When declaring goods at customs, businesses must consider multiple knife attributes to select the appropriate HS code. Key classification criteria include:

- Product name and type (e.g., table knife vs. folding knife)

- Material composition (stainless steel, aluminum, plastic, etc.)

- Design features (fixed vs. folding blade)

- Product state (complete knife vs. replacement blade)

These factors all influence final HS code determination and must be clearly specified in declarations.

International Considerations and Compliance

The global marketplace presents varying regulatory standards, safety requirements, and cultural preferences regarding knives. Exporters must ensure their products comply with destination market regulations while accounting for cultural differences. Certain knives may be classified as controlled items in some jurisdictions, making thorough understanding of local laws essential—particularly for export-focused businesses.

In summary, HS Code 82.11 encompasses a diverse range of cutting implements, and understanding its classification logic and applications forms the foundation for smooth international trade operations. In our increasingly globalized economy, mastering this knowledge not only enhances trade efficiency but also helps avoid risks and losses stemming from classification errors. Businesses must prioritize accurate product classification to ensure compliant and efficient trade processes—a fundamental requirement that serves as the necessary foundation for advancing international commerce.