As cross-border e-commerce sellers prepare their sales strategies for the new year, a tariff announcement from Pakistan has sounded an alarm for industry participants. The country's National Tariff Commission has decided to maintain anti-dumping duties on suspension-grade polyvinyl chloride (PVC) resin originating from mainland China, South Korea, Thailand, and Taiwan for another three years, effective until January 2, 2026. The duty rates for Chinese exporters/producers range from 3.44% to 20.47%.

Anti-Dumping Duty Details

The measure applies to PVC resin products classified under Pakistan Customs tariff code 3904.1090. Notably, exemptions exist: the duties won't apply when PVC resin is used exclusively as raw material for Pakistan's export products, or when involved in foreign donation aid programs and other tariff-exempt projects.

PVC Applications and Market Impact

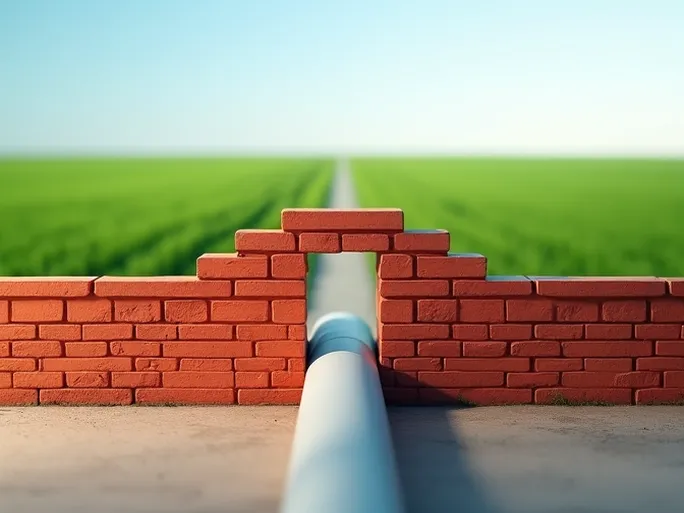

Polyvinyl chloride, a versatile thermoplastic polymer, can be processed through extrusion, injection molding, calendering, and blow molding into various forms including pipes, fittings, rods, profiles, films, and sheets. These products see widespread use in construction, light industry, agriculture, electrical applications, and daily necessities—from wire insulation and synthetic leather to floor tiles, toys, footwear, bottles, records, foam materials, and sealing components.

The extended anti-dumping measures will likely increase import costs for Pakistani downstream industries reliant on Chinese PVC, while directly affecting Chinese manufacturers exporting PVC products to Pakistan. Cross-border e-commerce merchants selling PVC-containing goods to Pakistan should closely monitor these tariff adjustments and adapt their business strategies accordingly.

Strategic Recommendations for E-Commerce Sellers

Industry participants may consider the following approaches to mitigate the impact:

- Diversify supply chains: Identify alternative suppliers to reduce dependence on single-source materials.

- Adjust product mix: Rebalance inventory to decrease the proportion of affected items.

- Enhance product value: Offset tariff pressures through technological innovation and design improvements that increase competitiveness.

- Monitor policy developments: Stay informed about regulatory changes in Pakistan's trade policies.

- Seek expert guidance: Consult international trade specialists for comprehensive solutions.

While presenting challenges, these anti-dumping measures also create opportunities for adaptive businesses. Proactive strategic adjustments will be crucial for maintaining competitiveness in this evolving market landscape.