The familiar sight of "invite friends, split cash" links flooding social media platforms has returned with a vengeance - this time on American shores. Temu, the international e-commerce platform owned by Chinese retail giant Pinduoduo, is replicating its domestic success through aggressive user acquisition tactics and rock-bottom pricing strategies that are rapidly reshaping the U.S. online shopping landscape.

The Viral Growth Engine: Burning Cash for Market Share

A recent screenshot circulating among cross-border e-commerce circles reveals Temu's straightforward referral program: users receive approximately $20 (150 yuan) for every three successful referrals who download the app. This cash-for-users approach mirrors Pinduoduo's playbook that propelled its meteoric rise in China - sacrificing short-term profits for explosive user growth. The strategy appears effective; within just two months of launch, Temu soared to the top of the U.S. App Store's free shopping apps, surpassing established players like Amazon and SHEIN.

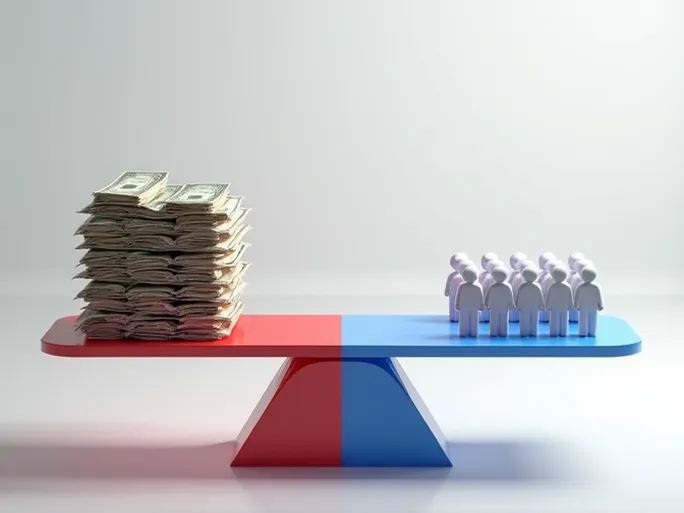

However, Wall Street remains skeptical about this growth-at-all-costs model. Despite Temu's impressive U.S. performance, Pinduoduo's stock price plummeted, wiping out $200 billion (140 billion yuan) in market value overnight. This investor caution reflects fundamental concerns about the platform's long-term viability beyond its initial promotional blitz.

The Double-Edged Sword of Discount Pricing

Temu's success largely stems from its unbeatable prices on everyday goods, but history suggests this approach carries significant risks. The cautionary tale of Wish, another cross-border e-commerce platform that rose rapidly through aggressive discounting before losing momentum, looms large. Industry analysts warn that price-sensitive customers attracted through cash incentives typically demonstrate low loyalty - a vulnerability that could trigger mass exodus when subsidies eventually decrease.

The platform faces the critical challenge of transitioning from a bargain destination to a sustainable business model. Building customer retention through service quality, product selection, and brand trust represents Temu's next evolutionary hurdle - one that previous discount-focused platforms failed to clear.

Global Ambitions: From North America to Emerging Markets

Pinduoduo's international aspirations extend far beyond its successful North American beachhead. Market intelligence suggests Temu is simultaneously laying groundwork in Africa, where it has already cracked the top 200 shopping apps in multiple countries and reached 22nd position in Cameroon's Google Play rankings. This parallel expansion reflects a strategic bet on underserved markets with growth potential, though infrastructure limitations and payment system fragmentation present formidable obstacles.

The company appears to be testing a "rural encirclement" strategy - establishing footholds in smaller markets before targeting major economic centers. Whether this approach can succeed where others failed remains an open question, but Temu's early progress suggests Pinduoduo's operational expertise translates surprisingly well across diverse international contexts.

Niche Markets Reshaping Global E-Commerce

Temu's rapid ascent coincides with broader industry recognition of untapped potential in emerging markets. SHEIN's remarkable success in Mexico - where it generated $592 million in 2021 fashion sales, doubling its nearest competitor - demonstrates the lucrative opportunities outside traditional Western strongholds. Seasonal shopping events like Mexico's "El Buen Fin" (often called the country's answer to Singles' Day) have become crucial battlegrounds for cross-border sellers, particularly in electronics, appliances, and fashion categories where promotional pricing drives conversion.

The Road Ahead: Challenges and Opportunities

Temu's disruptive entry has irrevocably altered the global e-commerce ecosystem. While its low-price, high-growth model delivers impressive short-term metrics, long-term success hinges on solving complex challenges including supply chain optimization, brand differentiation, and intellectual property protection. The platform's direct-from-factory sourcing and on-demand production systems provide cost advantages, but maintaining quality control and delivery reliability across international borders remains an ongoing operational challenge.

For merchants, Temu represents both opportunity and disruption - a powerful new sales channel that simultaneously intensifies pricing pressure. Adapting to this new competitive reality requires strategic reassessment of value propositions and operational efficiencies. As Temu continues refining its marketing mix - combining referral incentives with social media campaigns, influencer partnerships, and customer experience investments - the e-commerce landscape appears poised for further transformation.

Whether Temu can replicate Pinduoduo's domestic dominance on the global stage remains uncertain, but its dramatic entrance has already forced competitors to reassess their strategies. In the evolving battle for international e-commerce supremacy, one truth emerges clearly: the age of undisputed Western platform dominance has ended, and the rules of engagement are being rewritten in real time.