In the increasingly competitive global e-commerce market, platforms Temu and TikTok Shop are disrupting traditional shipping models through their distinct cross-border logistics strategies, presenting both opportunities and challenges for sellers.

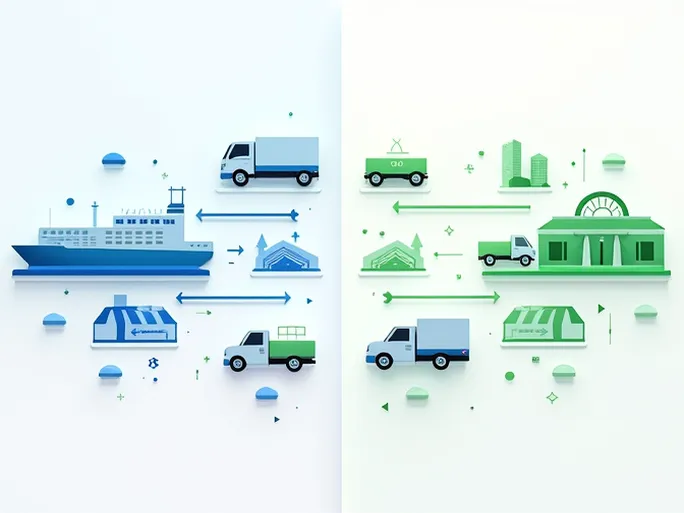

Temu's Cost-Efficient "Fast Ship + Certified Warehouse" Model

Temu has partnered with top shipping companies like Matson, ZIM, and CMA CGM to create dedicated "fast ship" services that reduce China-to-US West Coast transit times to just 11 days while cutting costs by 30%-60%. This approach proves particularly effective for bulkier items and seasonal products. For instance, home goods shipped in bulk to West Coast warehouses before nationwide distribution can reduce delivery expenses by over 40% compared to direct air freight.

The platform mandates sellers to use certified overseas warehouses—such as Yiba Supply Chain's facilities in Germany and Newegg's US warehouses—which enjoy direct system integration with Temu. These warehouses receive approximately 20% greater product visibility through search prioritization and traffic advantages. However, this model demands exceptional inventory turnover rates, requiring sellers to implement dynamic replenishment systems combining "sea freight for restocking + air freight for product testing" to prevent overstocking during sales fluctuations.

TikTok Shop's Flexible "Content-Driven + Warehouse-Delivery Separation" Approach

In contrast, TikTok Shop employs a logistics framework that prioritizes content virality and operational flexibility. Its "platform-connected warehouse" program allows sellers to choose from approved overseas facilities while automatically syncing order data through API integrations. The platform offers multiple fulfillment options including FBT official warehouses, third-party logistics partners, and direct cross-border shipping—particularly advantageous for small-to-midsize sellers capitalizing on viral video moments.

A notable example includes a cosmetics brand achieving 72-hour delivery for trending products through Los Angeles warehouses, combined with influencer livestreams to triple conversion rates compared to traditional e-commerce. TikTok enforces stringent logistics transparency requirements, exempting connected warehouse orders from "virtual overseas warehouse" evaluations that might otherwise penalize stores for shipping irregularities.

By 2025, new regulations will require US-based cross-border stores to fulfill orders domestically, raising operational barriers. While offering greater flexibility, TikTok's model demands strong product selection capabilities and content marketing expertise from sellers.

Divergent Strategies for Different Market Needs

The logistics approaches highlight fundamentally different business philosophies: Temu prioritizes mass-scale cost efficiency through controlled shipping and warehousing, while TikTok leverages social media dynamics and adaptable supply chains to function as a product incubator. Both models face potential challenges from possible changes to the US $800 de minimis tariff exemption threshold, which may require sellers to reevaluate their logistics strategies.