In today's globalized economy, international trade has become a primary business opportunity for many companies. However, as goods cross borders, customs clearance emerges as a critical process that cannot be overlooked. More than just a legal requirement, proper customs clearance ensures the safe and efficient arrival of goods at their destination. This article provides an in-depth analysis of customs clearance procedures, key considerations, and its vital role in international commerce.

Understanding Customs Clearance

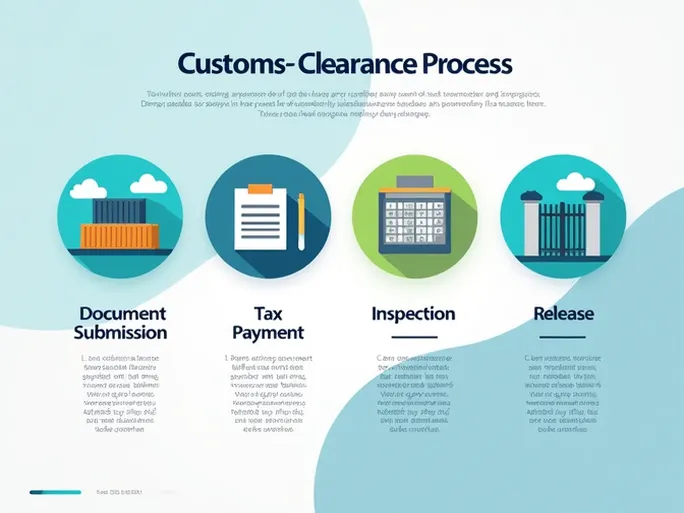

Customs clearance refers to the process of complying with a country's laws, policies, and regulations to ensure goods enter or leave a territory legally and safely. This multifaceted procedure involves document submission, tax payments, inspections, quarantine measures, duties assessment, and final release. Each component plays an indispensable role in facilitating smooth customs processing.

A fundamental question arises: When does customs clearance occur? The duration varies significantly based on multiple factors including the type of goods, destination country, and relevant regulations. Typically, clearance procedures begin immediately after goods arrive at the destination port or airport. Preparing all required documentation in advance can prevent unnecessary delays.

Who Handles Customs Clearance?

Businesses have two primary options for managing clearance:

- Self-clearance: The owner handles all procedures personally

- Customs brokers: Professional agents manage the process

For small and medium enterprises new to international trade, engaging experienced customs brokers often proves advantageous. These professionals offer specialized knowledge to:

- Prepare and verify documentation accuracy

- Calculate and process duty/tax payments

- Obtain special permits and approvals

- Navigate complex regulatory requirements

Essential Documentation

While requirements vary by country, these core documents are typically mandatory:

- Commercial invoice and contract: Evidence of transaction value

- Packing list: Detailed specifications of quantity, weight, and dimensions

- Transport documents: Bill of lading, air waybill, or other shipping records

- Product description and classification: Clear information about goods' nature, materials, and intended use, categorized according to the destination's tariff system

For example, when shipping electronics from China to the U.S., exporters must provide invoices, packing lists, bills of lading, and comprehensive product descriptions. These documents collectively verify the shipment's legitimacy and enable proper customs assessment.

Critical Considerations

Successful customs clearance requires attention to several key aspects:

1. Advance Preparation: Research destination countries' specific regulations to ensure complete documentation.

2. Compliance Accuracy: Provide truthful, complete information to avoid penalties for misdeclaration or omissions.

3. Tax Obligations: Fulfill all import duties and tax payments according to local laws.

4. Special Commodities: For regulated items like food, pharmaceuticals, or chemicals, obtain necessary permits and certifications. Japan's stringent food import requirements, for instance, demand pre-approved import licenses plus quality inspection reports.

5. Professional Assistance: When unfamiliar with procedures, reputable customs brokers can ensure compliant, efficient processing.

Consider textile shipments to European markets: various nations impose different testing requirements for fabric composition and quality. Understanding these specifications prevents clearance bottlenecks and potential rejections.

Conclusion

Customs clearance stands as a pivotal component in international logistics, encompassing legal, procedural, and regulatory dimensions. Mastering its fundamentals—whether through self-management or professional brokerage—ensures compliant, efficient cross-border movement of goods. Maintaining transparency and adherence to regulations remains paramount for lawful entry into foreign markets. As global trade continues to expand, effective customs clearance practices will remain essential for fostering economic growth and international business success.