Imagine a construction project stalled indefinitely due to critical material shortages—delayed timelines, ballooning costs, and frustrated clients. This isn't hypothetical but the current reality facing the building industry. GMS, a leading distributor of interior construction products, is implementing aggressive inventory strategies to maintain stability amid turbulent supply chains.

Inventory Strategy: The Defense Against Supply Chain Volatility

GMS CFO Scott Deakin revealed during Q2 earnings calls that the company has significantly increased inventories of drywall and steel to combat prolonged lead times and surging demand. Despite facing what Deakin called "pervasive supplier pricing behavior" driving up material costs, GMS prioritized procurement to ensure client needs are met. CEO John Turner noted steel delivery windows reaching 12 weeks—five times normal durations—forcing larger advance orders.

Drywall: Improved Supply With Persistent Risks

While drywall availability has shown modest improvement, Turner cautioned that plant maintenance, seasonal fluctuations, and other variables continue posing challenges. "This situation may not change," he stated, indicating GMS must maintain vigilance. Competitor Foundation Building Materials similarly projects drywall shortages extending through 2022.

Twin Pressures: Soaring Demand and Price Inflation

As construction backlogs clear, drywall demand has spiked dramatically. Eagle Materials, a major U.S. gypsum wallboard producer, implemented 33% year-over-year price increases. CEO Michael Haack confirmed control over most raw materials while leaving room for additional hikes, signaling sustained cost pressures for distributors like GMS.

GMS's Countermeasures: Balancing Inventory and Pricing

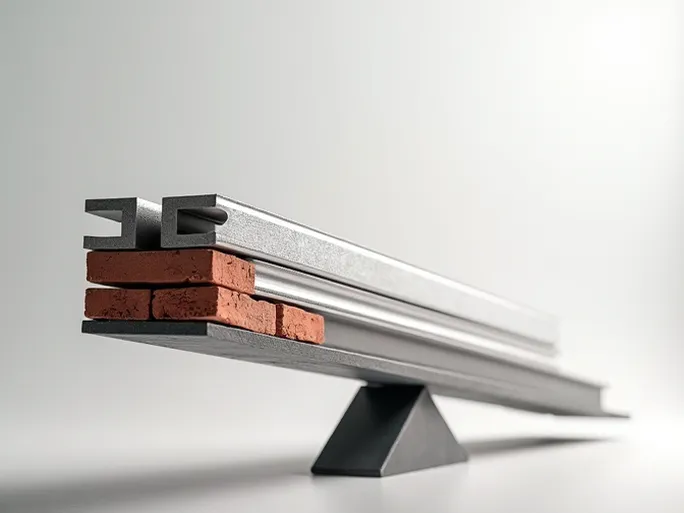

The distributor of commercial/residential drywall, ceilings, steel framing, and related products continues absorbing quarterly supplier price increases while expanding orders. "With extended lead times, we're driven to hold more unit inventory," Turner explained. This strategy requires greater capital allocation toward stockpiles and elevated warehousing expenses.

Steel: Gradual Lead Time Recovery

Steel delivery intervals show marginal improvement but remain "nowhere near pre-pandemic or even early-pandemic levels," according to Turner. Foundation Building Materials attributes steel shortages and record pricing to mill production shortfalls, with spokesperson Kirby Thompson stating: "We don't expect meaningful change before 2022."

Market Outlook: Continued Price Growth and Demand Variability

Though drywall price escalation shows signs of moderation, GMS anticipates 2022 increases. Turner reported a 1.1% drywall sales decline, with commercial volume lagging residential as supply contends with seasonal impacts. "Demand should remain reasonable...with potential for slightly extended drywall lead times regionally," he projected.

Refining Inventory Management

GMS's proactive approaches include:

- Advanced demand forecasting: Leveraging market analytics to predict needs and adjust inventories preemptively

- Supply chain optimization: Strengthening supplier partnerships to stabilize material flows

- Procurement diversification: Reducing single-source dependencies through expanded vendor networks

- Lean inventory principles: Minimizing excess stock to improve turnover and reduce carrying costs

Measuring Strategic Success

GMS's inventory strategy represents a calculated risk management approach during unprecedented supply disruptions. By combining predictive analytics with operational flexibility, the company aims to sustain service levels while navigating inflationary pressures. The effectiveness of these measures will ultimately depend on execution and broader market conditions, but GMS's methodology offers an instructive model for the industry.

Additional initiatives include technology investments in AI-driven forecasting, enhanced employee training in supply chain management, and comprehensive risk assessment frameworks. These efforts collectively strengthen resilience against future disruptions while maintaining competitive positioning.

For the construction sector at large, GMS's experience underscores the growing imperative of supply chain agility. Companies must develop responsive systems capable of absorbing shocks while meeting client commitments—a challenge requiring strategic inventory management, diversified sourcing, and contingency planning as standard practice.