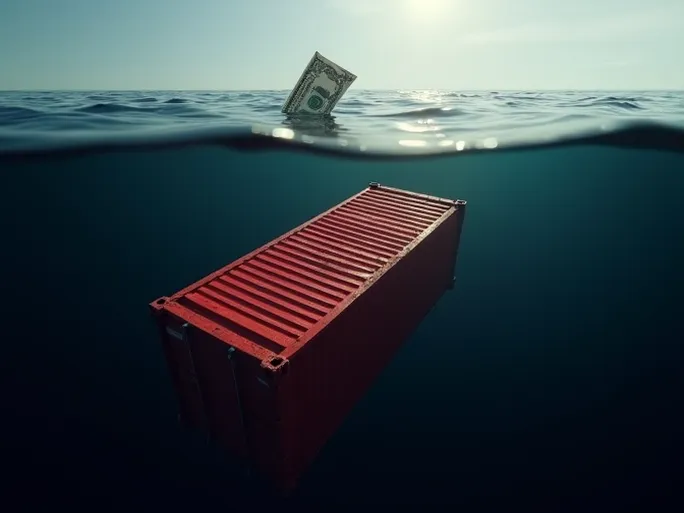

Imagine meticulously preparing and shipping goods, only to see profits vanish because of a single document—the bill of lading. For cross-border e-commerce sellers, few scenarios are more devastating than having cargo detained or lost due to incorrect paperwork. The root of this nightmare often lies in misunderstanding the differences between a Master Bill of Lading (MBL) and a House Bill of Lading (HBL). Here’s what you need to know to avoid costly mistakes.

Who Issues the Document?

The Master Bill of Lading (MBL) is issued directly by ocean carriers such as MSC, Maersk, or COSCO. In contrast, the House Bill of Lading (HBL) is issued by freight forwarders, who must hold a valid Non-Vessel Operating Common Carrier (NVOCC) license. In essence, the MBL represents a direct contract with the shipping line, while the HBL involves an intermediary.

Delivery Process: Time and Cost Implications

With an MBL, consignees can present the document directly to the carrier’s agent at the destination port to obtain a delivery order, streamlining customs clearance. However, an HBL requires an additional step: the consignee must first exchange it for an MBL through the local freight forwarder. This "switch" process often incurs unpredictable fees determined by the destination agent, creating opportunities for hidden charges.

Legal Weight and Financial Utility

An MBL is a negotiable instrument under maritime law, serving as definitive proof of cargo ownership. It facilitates trade financing, letter-of-credit transactions, and collateralization. While an HBL can sometimes function as a title document, its acceptability depends heavily on the forwarder’s credibility and global network, making it less reliable for financial purposes.

When to Use Which Document?

- MBL: Typically used for full-container-load (FCL) shipments where the exporter controls the entire container.

- HBL: Required for less-than-container-load (LCL) shipments, as consolidators must issue individual consignee bills. It’s also common in FOB terms, freight-collect deliveries, DDU/DDP door-to-door services, and triangular trade arrangements.

Risks of Choosing Incorrectly

Opting for an HBL carries significant hazards. If the destination agent becomes unresponsive, goes bankrupt, or—worse—withholds documents maliciously while the MBL has already been claimed by another party, the consignee loses all recourse. Even MBLs aren’t risk-free: with straight bills (non-negotiable), carriers may release cargo to named recipients without requiring the original document.

For cross-border sellers, selecting the appropriate bill of lading demands careful consideration of shipment terms, financial needs, and risk tolerance. Professional logistics consultants can provide tailored guidance to optimize security and efficiency.