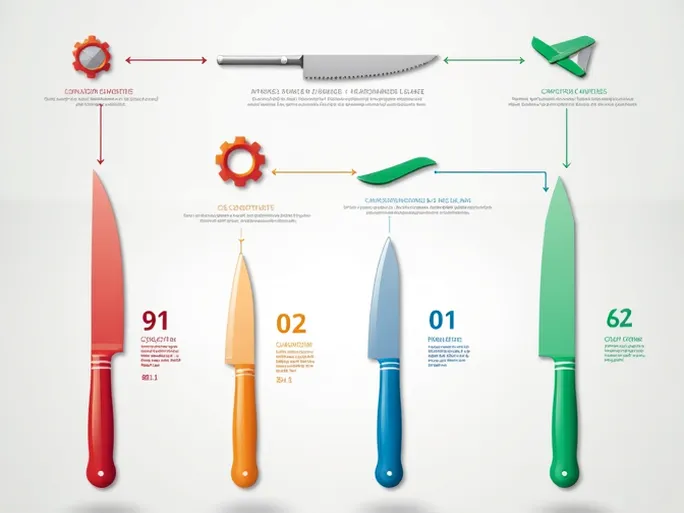

In international commerce, the classification of goods transcends mere administrative procedure—it serves as a pivotal factor influencing business operational efficiency. Within this realm, the proper categorization of bladed knives and their blades emerges as particularly crucial. According to specific provisions in the Harmonized System (HS) Code, these products primarily fall under Chapter 82, specifically heading 82.11. The distinct characteristics and subdivisions within this classification demand careful examination for accurate understanding and application.

Defining 82.11: The Blade Classification Framework

Heading 82.11 encompasses bladed knives regardless of whether they feature serrated edges, with applications spanning kitchen, industrial, and outdoor environments. This classification not only enables clear identification of knife characteristics but also establishes the essential tariff framework for international trade.

Comparative Analysis: 82.11 vs. 82.08

82.11 doesn't exist in isolation. A meaningful comparison emerges when examining heading 82.08, which covers mechanical or machine-operated knives such as woodworking machine blades or food processing equipment cutters. These specialized tools demonstrate marked differences in form and function compared to conventional table knives or outdoor blades.

The 82.08 classification features specific identifiers including:

- 8208101100: Metalworking machine tools with hard metal coatings

- 8208200000: Woodworking machine blades

This granular classification provides precise market positioning and facilitates customs clearance procedures.

Decoding HS Codes Within 82.11

The complexity of knife classification necessitates deeper examination of specific HS codes under 82.11:

8201110000 represents knife-dominated sets typically found in high-end culinary environments, combining practical utility with aesthetic appeal.

8211910000 covers fixed-blade table knives that serve both functional and cultural purposes. International traders must consider not just product specifications but also cultural connotations surrounding knife use across different societies.

8211920000 includes other fixed-blade knives with broader industrial applications from domestic kitchens to professional restaurants, making them popular export commodities.

8211930000 addresses folding knives like Swiss Army knives and multi-purpose tools, whose classification depends on specific technical definitions despite their versatile applications.

8211940000 specifically covers blades themselves—a critical component where material composition, thickness, and design directly impact performance and safety. The industrial blade market offers significant opportunities for manufacturers and traders alike.

Practical Applications and Market Implications

Major culinary trade shows demonstrate these classifications in action, where new knife designs showcase both craftsmanship and practical utility under the 82.11 framework. These exhibitions provide tangible product experiences while generating valuable market insights.

The often-overlooked 8211950000 —covering base metal knife handles—holds particular significance in certain markets, influencing both production costs and consumer preferences. Understanding these nuances enables smarter commercial decisions.

Conclusion: Classification as Competitive Advantage

Proper knife and blade classification forms the foundation of market competitiveness—not merely an administrative task but a strategic understanding of product value chains. Detailed analysis of 82.11 and 82.08 subcategories enhances reporting accuracy, facilitates market expansion, and ensures global compliance. Within these complex classification rules lies opportunity—by mastering this system, businesses can significantly enhance their international trade operations.