In modern industrial and laboratory applications, the use of precious metals has become increasingly widespread, with rare metals such as platinum holding particular importance. The customs commodity code 7115901090 has been assigned a unique position for these specialized applications, covering other industrial and laboratory articles of precious metal or metal clad with precious metal.

Commodity Code Definition and Applications

According to customs classification, HS code 7115901090 primarily identifies precious metal products used in industrial or laboratory environments. These products typically feature high heat resistance and corrosion resistance, making them exceptionally suitable for chemical experiments and high-tech applications. The official customs description as "other industrial and laboratory articles of precious metal or metal clad with precious metal" indicates their broad application potential.

Tariff Information and Key Metrics

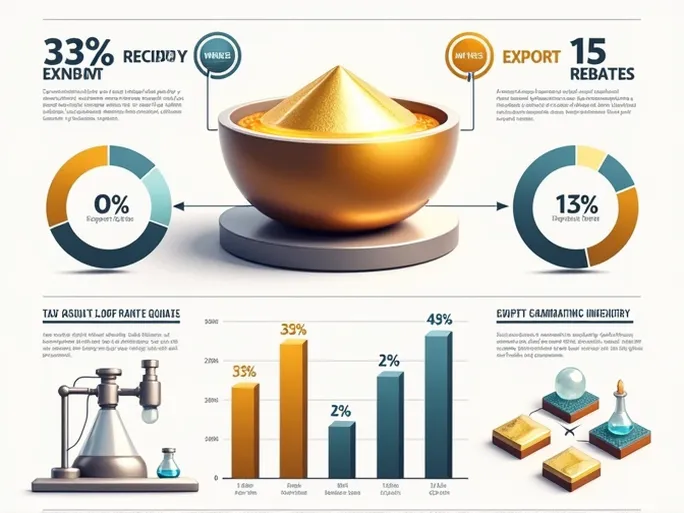

The code's status is currently active, with the latest update recorded on April 2, 2025. The comprehensive tariff structure includes:

- Unit of measurement: Gram (g)

- Export tax rate: 0%

- Export rebate rate: 13%

- VAT rate: 13%

- Most-favored-nation (MFN) rate: 3%

- General import tax rate: 11%

These fiscal parameters significantly impact operational costs and international trade strategies. The 0% export tax rate enhances global market competitiveness, while the 13% export rebate provides substantial cash flow support for manufacturers.

Detailed Declaration Requirements

Customs declarations for 7115901090 require precise completion of multiple elements to ensure smooth clearance. Mandatory declaration components include:

- Brand type classification

- Export preferential treatment status

- Intended use (industrial/laboratory applications)

- Product type (e.g., crucibles)

- Physical form (e.g., grid shape)

- Material composition (e.g., platinum)

- Precious metal content percentage

- Brand name (in original language or transliteration)

- Model number

- Global Trade Item Number (GTIN)

- Chemical Abstracts Service (CAS) number

- Other unified identification information

These rigorous requirements aim to enhance transaction transparency and safeguard the interests of trading parties.

Regulatory Conditions and Inspection Protocols

Currently, no special regulatory conditions apply to this commodity code, nor are there specific inspection and quarantine categories. This regulatory simplicity facilitates smoother transactions for manufacturers and exporters by reducing procedural uncertainties.

International Agreement Rate Analysis

Examination of preferential tariff agreements reveals that numerous countries apply a 0% duty rate to this commodity. This includes members of the Association of Southeast Asian Nations (ASEAN), Chile, Pakistan, New Zealand, Switzerland, and several other jurisdictions, demonstrating the product's global acceptance and trade facilitation.

Conclusion

HS code 7115901090 serves as a specialized identifier for precious metal applications in industrial and laboratory settings, while its associated tariff policies provide substantial support to relevant enterprises. As globalization continues to deepen, the market potential for these specialized products will likely expand further. Industry participants should maintain close monitoring of policy developments related to this classification to ensure ongoing compliance and competitive positioning.