In international trade, export tax rebates are a crucial concern for businesses, especially export-oriented enterprises. How can companies efficiently and successfully complete their export tax rebate applications? This article systematically outlines the export tax rebate process, eligibility criteria, and key considerations to help businesses avoid common pitfalls and maximize policy benefits.

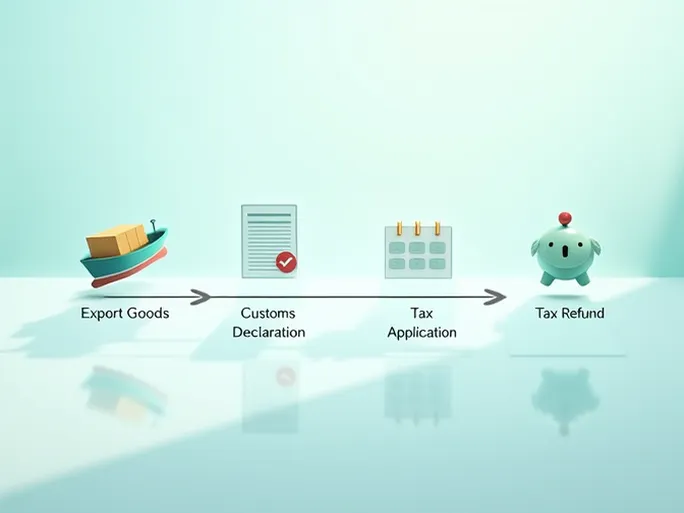

I. The Export Tax Rebate Application Process

For export tax rebates, companies must first apply for a special tax rebate customs declaration form (light yellow) from customs authorities promptly after goods are loaded for export. There are two export methods available to declaring enterprises:

- Direct Port Processing : Companies handling export procedures directly at port customs must apply for tax rebates after completing the procedures.

- Inland Customs Transfer : For goods declared at inland customs before being transferred to port customs for export, companies must apply after receiving transfer confirmation.

Customs authorities will issue special export declaration forms based on actual export quantities, prices, and other information, while collecting visa fees. The issuance period runs from the date when the transport vehicle completes customs procedures until the day of customs release. Companies must carefully note these critical timelines.

II. Eligibility Criteria for Tax Rebates

According to regulations, products eligible for tax rebates must meet three key conditions:

- The products must fall within the scope of product tax, value-added tax, and special consumption tax.

- Goods must be physically declared and depart the country—only items that clear customs qualify as exports.

- Financial records must show export sales, ensuring legal and regulatory compliance.

These three conditions form the fundamental prerequisites for tax rebate applications, all of which must be satisfied. Additionally, special national policies may apply to certain products, requiring particular attention from businesses.

III. Preparation of Customs Declarations and Invoices

In the export tax rebate process, the proper preparation of customs declarations and invoices is particularly important. Regarding customs declarations, companies should focus on these key definitions:

- Customs Declaration Entry Voucher : A form completed by the company according to customs format, used for pre-entry of customs declarations.

- Pre-entered Customs Declaration : A declaration entered and printed by a pre-entry company before being transmitted to customs.

- EDI Customs Declaration : A declaration submitted to customs through Electronic Data Interchange (EDI) systems.

As invoices serve as critical supporting documents, their contents must be completely accurate. The preparation process requires clear, neat formatting with proper layout. Ensuring invoice quality forms the foundation for smooth customs clearance and tax rebate procedures.

IV. Conclusion

Export tax rebates can significantly enhance a company's competitiveness, but they require thorough understanding of relevant policies and procedures. Through proper operational processes and compliant financial management, businesses can successfully complete export tax rebate applications and enjoy policy benefits. Staying informed about customs changes and policy updates while continuously optimizing internal procedures will better position companies to gain competitive advantages in the intense global marketplace.