In the current economic environment, the freight industry plays a crucial role as an indispensable link in the logistics chain. To ensure tax compliance in this sector, the government has established clear regulations and procedures for freight invoice issuance. The proper handling of new version freight invoices not only concerns corporate tax compliance but also impacts the healthy development of the entire industry.

Therefore, taxpayers applying for freight invoice issuance must fully understand the relevant requirements and processes to protect their legitimate rights and interests.

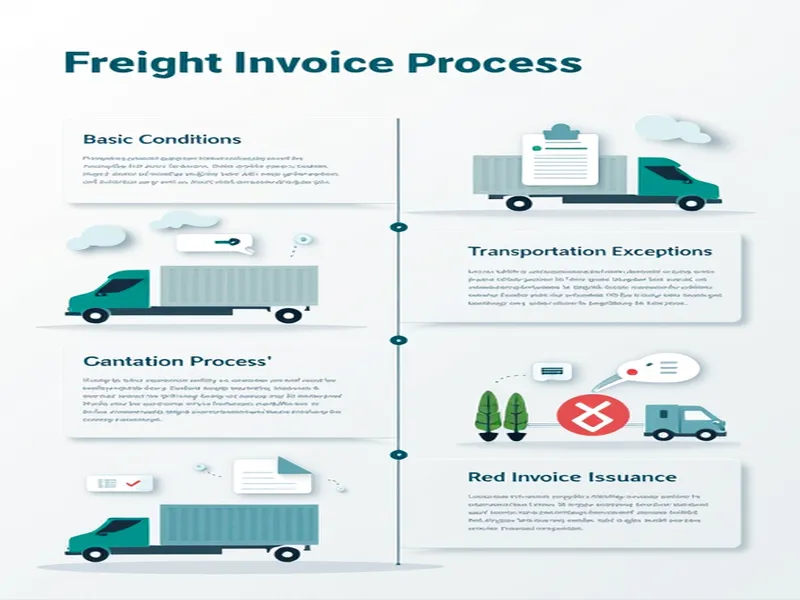

Three Fundamental Requirements for Freight Invoice Issuance

First, taxpayers must provide proof of payment from the client or a transportation contract before applying for freight invoice issuance. This requirement aims to ensure transaction authenticity and legality while preventing fraudulent invoicing. These documents also serve as evidence for subsequent tax inspections, maintaining transaction transparency.

Second, the invoice issuer must provide valid identification materials. Individual taxpayers must submit copies of legal identification documents, while corporate taxpayers must provide copies of their tax registration certificate. These documents serve as basic requirements for invoice issuance and important evidence to ensure the legality of the process.

Third, applicants must accurately complete the invoice application form, which typically includes key information such as project name, content, and amount. Precise information helps tax authorities process applications more efficiently while reducing unnecessary delays.

Special Considerations for Transportation Services

Taxpayers should pay special attention to handling special circumstances regarding pricing and mileage in transportation operations. When unit freight rates and mileage are unclear, taxpayers may leave these fields blank in the "freight items and amounts" section, maintaining operational flexibility while avoiding misunderstandings from tax authorities.

Invoice Cancellation Procedures

For invoice cancellation, taxpayers must first process the cancellation in the tax control system to ensure accurate records. Paper invoices must be clearly marked with "VOID" for future verification. All copies of canceled invoices must have their supervision seal areas clipped to confirm invalidation.

Valid cancellation requires that invoices be returned within the month of issuance and before any data transmission occurs.

Red Invoice Issuance and Tax Refunds

Businesses sometimes need to issue red freight invoices, which requires following specific procedures. Red invoices can only be issued after retrieving all copies to ensure completeness and traceability. If copies cannot be retrieved, businesses must apply to tax authorities for a notification document as replacement.

Regarding tax refunds, businesses must obtain tax authority approval and present a "Tax Revenue Refund Document" to complete the process. This procedure ensures companies receive funds promptly while maintaining compliance.

Staying Compliant in a Changing Industry

As the freight industry evolves, tax management requirements continue to rise. Taxpayers must proactively enhance their tax knowledge and stay current with policy changes to ensure accurate and efficient tax handling. Modern information technologies like tax software and online platforms can help reduce manual errors and improve invoicing efficiency.

In today's fast-paced environment, only companies with robust tax management systems can remain competitive. Freight invoice issuance isn't merely procedural—it carries legal responsibilities and business ethics. While focusing on compliance, companies should also consider building their brand reputation, as strong tax records become important components of corporate credit that create future opportunities.

Facing complex tax matters, taxpayers must maintain constant vigilance and effective self-management to ensure operational standardization and compliance, thereby promoting the freight industry's healthy and orderly development.