The cargo sources for dedicated highway truckload freight primarily originate from three channels: First, transshipment goods extended from other interprovincial routes; second, goods from third-party logistics, commerce, and manufacturing sectors; and finally, retail and township-level shipments from wholesale markets. Each category possesses distinct characteristics—transshipment goods serve as supplementary cargo during off-peak seasons but are often abandoned when demand surges. Manufacturing and third-party logistics shipments typically involve stringent KPI requirements and extended payment cycles. In contrast, wholesale market LTL (less-than-truckload) shipments command premium rates, immediate payments, and generate value-added services including cash-on-delivery, insurance premiums, and delivery fees, making them the long-preferred choice for regional LTL carriers.

I. Market Structure and Strategic Crossroads for Dedicated Routes

Since China's economic reform and opening-up, the rapid development of specialized wholesale markets—emerging as a response to state-owned distribution constraints—has fostered parallel growth in dedicated freight enterprises. However, contemporary commercial markets have undergone seismic shifts, with aggregation and distribution services becoming essential market infrastructure. Nearly every city now faces challenges in attracting tenants to newly constructed markets, compelling freight operators to reevaluate their business models and identify opportunities in this transformed landscape.

II. Information Disruptions and E-commerce Disintermediation

The current fragmentation of information flows within commodity trading markets, coupled with delayed logistics data feedback, creates significant uncertainty among trading entities. Manufacturers require real-time frontline data for strategic adjustments, yet distributor-provided information often leads to misjudgments. Traditional market distribution methods remain plagued by inefficiencies—high costs and operational delays that become particularly acute in tertiary markets where last-mile delivery bottlenecks prevail. Some trading markets have begun intervening directly in freight operations, leveraging their market credibility to enhance cargo acceptance, collateral management, and supervision.

III. The Current State of Wholesale Markets and Dedicated Routes

Wholesale markets continue to dominate as the primary source of LTL shipments, while transshipment and manufacturing volumes demonstrate steady growth. Although these segments command stronger pricing power, they simultaneously exert pressure on traditional freight operators.

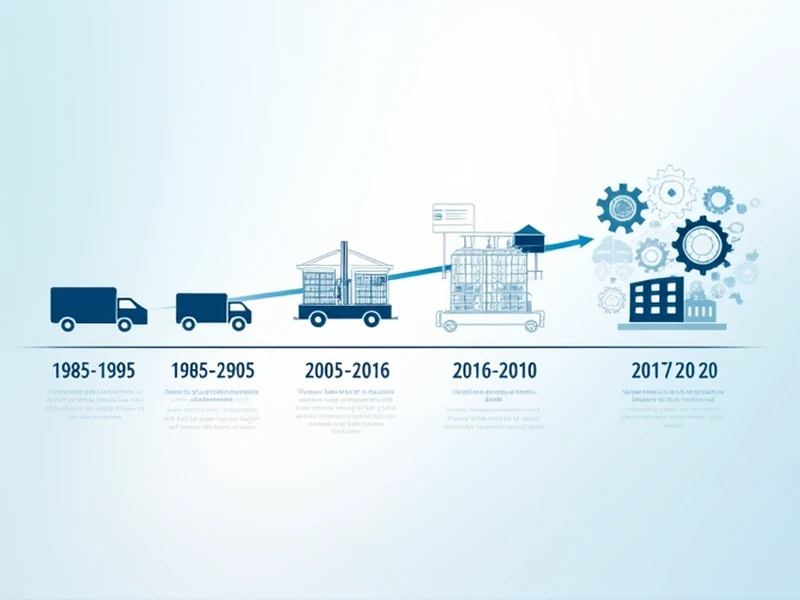

Historical analysis reveals five evolutionary phases in the development of freight routes and trading markets:

- 1985-1995: Independent wholesale logistics systems with high-cost, merchant-operated fleets

- 1995-2005: Gradual outsourcing to dedicated carriers, creating accountability challenges

- 2005-2016: Comprehensive warehousing and shipping outsourcing, establishing independent logistics management

- Post-2016: Emergence of supply chain management models elevating logistics' strategic role

IV. Urban Development Conflicts and Wholesale Market Limitations

Wholesale markets remain entrenched in cash-and-carry transaction models, constrained by rudimentary management approaches and inadequate service capabilities. Market investors frequently lack comprehensive operational resources and management expertise, forcing many merchants to rely on informal financing channels that inflate operating costs. Concurrently, the modernization of distribution systems lags, creating integration barriers for dedicated carriers attempting to establish local market presence.

V. The Decoupling of Sales and Inventory Management

A paradigm shift is occurring as wholesale market storefronts transition into showrooms, with inventory migrating to peripheral urban warehouses. This transformation necessitates fundamental restructuring of freight services and promotes "passenger-cargo separation" strategies—maintaining transactional activities at original locations while minimizing transportation congestion, though this approach simultaneously tests the limits of warehousing and distribution capabilities.

VI. Strategic Pathways for Volume Growth

To navigate market transformations, dedicated carriers must proactively adapt by exploring new growth vectors: entering warehousing sectors to control cargo sources, expanding through consumer finance offerings, and optimizing dispatch systems to enhance delivery efficiency. However, most operators face critical deficiencies in financial operations, significantly constraining their development potential.

In conclusion, the regional dedicated freight industry must prioritize understanding market evolution trends while building effective supply chain management and logistics service systems to achieve sustainable growth amidst wholesale sector transformations.