In the context of global economic integration, trade facilitation has become a key priority for governments worldwide. To achieve this goal, customs administrations across nations are continuously reforming existing policies to enhance trade efficiency. In China, the comprehensive implementation of the Customs Clearance Integration Reform since July 1, 2023, signifies a new phase in the country's customs system modernization, bringing significant benefits to businesses while profoundly impacting China's overall trade environment.

Understanding Customs Clearance Integration

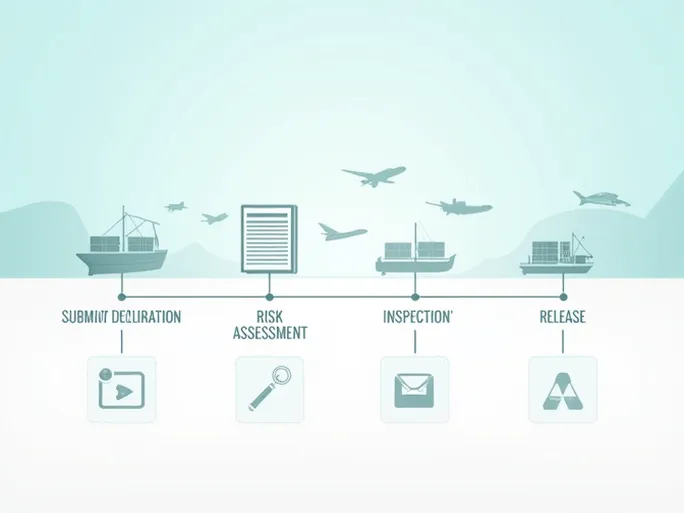

Customs clearance integration refers to the optimization of customs procedures by eliminating geographical restrictions, allowing enterprises to freely choose their declaration location nationwide while implementing unified risk control and supervision. Simply put, businesses are no longer confined to specific customs zones and can select the most suitable port for declaration. This reform aims to improve clearance efficiency, reduce corporate costs, and facilitate international trade development.

Core Principles of the Reform

The fundamental concept behind clearance integration is to establish a more efficient, convenient, and compliant customs system. As the global economy evolves, traditional clearance models have become inadequate, plagued by lengthy processes, complex procedures, and regional limitations. The reform addresses these challenges by streamlining operations and enhancing business flexibility.

Process Optimization: Balancing Compliance and Efficiency

1. Eliminating Geographical Restrictions

Previously, companies were required to declare goods at designated ports, creating logistical constraints. The new policy allows enterprises to select optimal ports regardless of location, significantly improving supply chain flexibility for both bulk trade and small-scale international procurement.

2. Streamlined Declaration Process

The "unified declaration, phased processing" approach enables businesses to submit all required information at once, while customs authorities conduct gradual reviews and releases. This eliminates repetitive paperwork and allows companies to focus on core operations.

3. Enhanced Clearance Efficiency

Data indicates average clearance times have been reduced by over 30%, providing substantial benefits for companies seeking faster time-to-market.

Business Benefits

The reform delivers measurable advantages across multiple operational aspects:

- Reduced Clearance Costs: Lower time and labor expenditures free up resources for R&D and market expansion

- Standardized Enforcement: Uniform customs standards minimize compliance risks and regional policy discrepancies

- Increased Flexibility: Adaptive port selection enables quicker responses to market opportunities

Implementation Framework

The phased rollout involves several key components:

- Establishment of national risk control and tax administration centers since 2017

- Consolidated declaration and review processes with "phased processing"

- Elimination of regional document review centers to accelerate processing

Tax Administration in the New Model

The reform elevates the role of tax administration centers through:

- Batch verification of tax-related declaration elements

- Post-clearance inspections to ensure compliance

- Optimized resource allocation through data sharing

Future Outlook and Corporate Strategies

While the reform offers significant advantages, it also demands enhanced corporate capabilities:

- Strengthened compliance awareness and policy monitoring

- Optimized internal management and cross-department coordination

- Proactive engagement with customs authorities and industry groups

- Adoption of blockchain and big data technologies for supply chain transparency

Conclusion

The Customs Clearance Integration Reform represents a transformative step in China's international trade development. By capitalizing on these changes, businesses can achieve operational efficiencies and sustainable growth, positioning themselves competitively in the evolving global marketplace.