In today's global trade landscape, import and export activities have become increasingly busy. As the key government agency overseeing cross-border goods, customs authorities not only collect tariffs and enforce import-export controls but also safeguard national economic security and maintain legitimate trade order. In this process, the customs declaration form serves as an indispensable document for import-export reporting. To standardize declaration practices and ensure data accuracy and compliance, these comprehensive guidelines were developed to provide businesses with clear, standardized references that enhance efficiency and transparency throughout the customs clearance process.

I. Background of the Standardization

With the growth of international trade, customs control requirements have become increasingly stringent worldwide. As the world's largest trading nation, China faces particularly complex and diverse customs declaration regulations. Under the guidance of the "Customs Law of the People's Republic of China" and related regulations, establishing clear documentation standards has become especially crucial. By ensuring accurate declarations, businesses can effectively reduce delays and penalties caused by reporting errors, thereby promoting healthier international trade development.

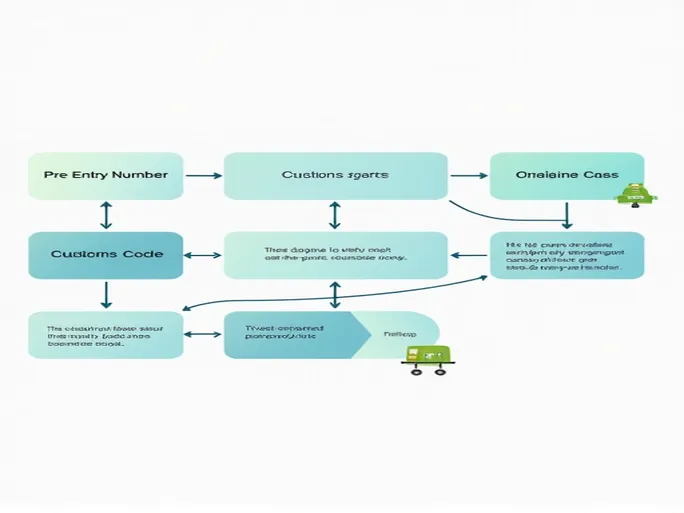

II. The Critical Role of Pre-entry Numbers

During the declaration process, the pre-entry number serves as a vital component. Generated by the customs system, this tracking number enables efficient management of declaration forms. Declarants must ensure accurate entry of this number to prevent any impact on expedited cargo clearance.

III. Understanding Customs Identification Numbers

Every declaration form requires an 18-digit customs ID number, comprising customs codes, calendar year, import/export indicators, and sequential numbering. This unique identifier not only facilitates customs management but also provides clear transaction records for trading parties, preventing disputes arising from information asymmetry.

IV. Requirements for Consignor/Consignee Information

Consignor and consignee details carry significant weight, as they verify cargo legitimacy and establish liability tracing. These entities must be legally registered Chinese organizations, with accurate name and code reporting mandatory. Acceptable codes include 18-digit unified social credit codes or 10-digit customs registration numbers. Standardized reporting enhances accuracy while ensuring trade compliance. Notably, when contracts involve multiple enterprises, the actual executing party should be designated as the reporting entity.

V. Port Information Specifications

In import-export declarations, port details directly affect clearance processes. Customs names and codes must reflect actual points of entry/exit, with particular attention required for special circumstances like transshipment or allocation.

For transshipped imports, declarations should specify entry-point customs to ensure smooth transit, while export transshipments require exit-point details. Similarly, cross-zone deep processing transfers demand clear indication of transfer-out locations on export forms. These standardized requirements enhance customs efficiency and reduce clearance times.

VI. Key Completion Techniques and Considerations

- Accuracy First: All information—especially regarding values, cargo descriptions, and involved parties—must precisely reflect reality.

- Format Compliance: Strict adherence to prescribed formats prevents processing delays caused by missing or incorrect entries.

- Timely Updates: Any changes to company information or supporting documents require immediate updates to maintain data currency.

- Policy Awareness: Regular monitoring of customs regulation updates enables timely adjustment of declaration strategies.

- Special Circumstances: Controlled commodities or origin-certified goods demand particular attention to specific regulatory requirements.

VII. Conclusion

These standardized declaration procedures establish uniform requirements that ensure lawful and accurate import-export reporting. Through meticulous data entry, businesses not only improve customs efficiency but also create smoother trade environments. For international traders, mastering these standards represents both a fundamental operational requirement and a crucial safeguard for legal rights. As global trade continues expanding in complexity, consistent adherence to these guidelines will remain vital for sustainable business growth.