In international trade, the choice of payment settlement method is crucial for a company's cash flow. Customs authorities regulate various forms of payment settlement, including mail transfers (M/T), telegraphic transfers (T/T), demand drafts (D/D), documents against payment (D/P), documents against acceptance (D/A), letters of credit (L/C), as well as "ship first, settle later" and "settle first, ship later" arrangements.

Among international settlement methods, telegraphic transfers (T/T) are widely used due to their straightforward procedures, while letters of credit (L/C) remain popular for their high security. Customs definitions of payment methods primarily concern how exporters or their agents receive foreign currency payments through banks.

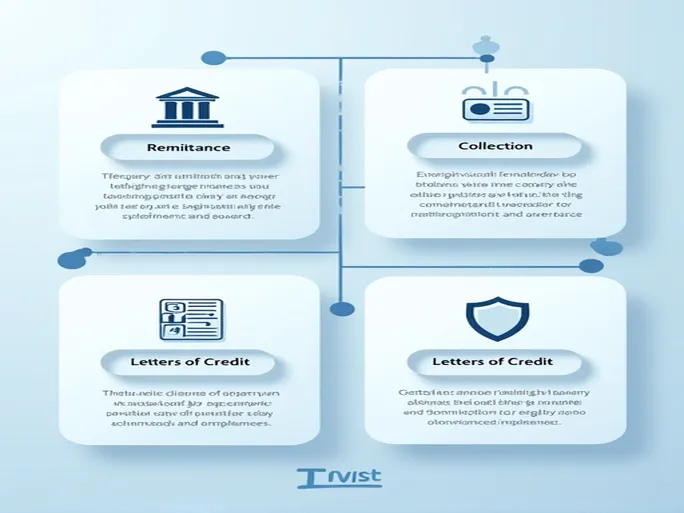

The customs payment method code table categorizes settlement options into four main types: remittance , collection , letters of credit , and other methods . The remittance category includes mail transfers, telegraphic transfers, and demand drafts. Collection methods encompass documents against payment and documents against acceptance.

Letters of credit serve as effective payment guarantees between buyers and sellers, ensuring transaction security. The "other methods" classification refers to settlement approaches not covered by the aforementioned categories.