In today's rapidly globalizing world, international mail has become an integral part of our daily lives. This phenomenon manifests not only in the prevalence of cross-border shopping but also in various forms of international exchange such as studying abroad and business communications. As this trend continues to strengthen, many people may find themselves eagerly awaiting a package only to receive a surprising notice from customs informing them that their shipment has been detained. What exactly is happening? This report aims to explore the customs processing procedures for international mail, common reasons for holds, and relevant tax policies to help readers better understand and navigate the complexities involved.

I. The Basic Customs Processing Workflow for International Mail

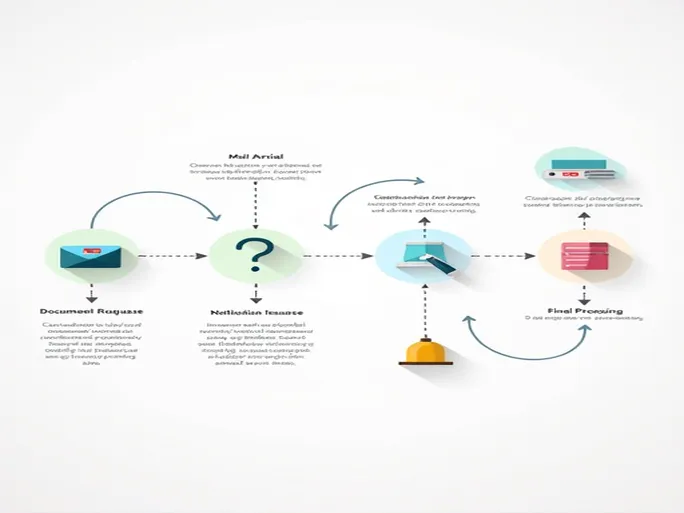

When international mail arrives in a specific country or region, it must undergo customs inspection. This process typically involves several essential steps designed to protect national economic interests and public safety. The basic mail processing workflow is as follows:

- Mail Arrival and Registration: Upon reaching customs, mail items are registered by customs officials.

- Classification and Inspection: Mail is initially sorted based on various classification criteria. Customs determines the nature, value, and type of package to decide whether further inspection is needed. High-value or suspicious packages undergo more thorough examination.

- Request for Additional Documentation: If customs requires more information for declaration or taxation purposes, they may temporarily hold the package and notify the recipient to provide relevant documents.

- Issuance of Processing Notice: After confirming the need for additional documentation, postal services will send the recipient a Mail Processing Notice based on customs' decision.

- Completion of Processing: Upon receiving the required documents, customs will review and process the package, ultimately deciding whether to release or return it.

II. Common Reasons for Mail Detention

Mail detention by customs typically doesn't occur because a package contains prohibited items. More often, holds are implemented to resolve documentation or procedural issues. Below are three common reasons for temporary mail detention:

- Requirement for Goods Declaration: If the value of goods in a package exceeds the duty-free allowance or other customs standards, recipients will be asked to provide declaration documents.

- Need for Pricing Documentation for Taxation: Customs must verify the actual value of items to determine applicable taxes. Failure to provide required purchase receipts or invoices will delay package release.

- Requirement for Return or Reshipment Procedures: In some cases, recipients may need to request package returns or address changes in advance, which can also lead to temporary detention.

In summary, customs inspection doesn't necessarily mean package confiscation but rather ensures compliance with import regulations and policies.

III. Understanding Tax Policies

Many people wonder why personal-use items still face customs taxation. This is fundamentally tied to national import tax policies. Taxation serves as a crucial economic development tool, with customs controlling cross-border transactions through taxation to protect domestic markets and economic interests. Key tax categories in this process include:

- Tariffs: Applied to certain goods and items based on their classification and value. Tariffs affect not just tax amounts but also market prices.

- Value-Added Tax (VAT): Typically applied to all imported goods, calculated based on dutiable value.

- Consumption Tax: Levied on specific categories like luxury goods.

Particularly noteworthy is postal tax, a form of taxation for personally mailed inbound items not intended for commercial use. Generally, mail taxation applies in two main scenarios:

- Items Exceeding Personal Use Allowances: When item values exceed customs' duty-free thresholds, they require formal declaration including applicable tariffs and VAT.

- Regular Personal Mail Items: Even when mail value falls within duty-free limits, accurately declared items may still be taxed based on customs assessment.

Therefore, recipients must truthfully declare item values when submitting mailing information and retain purchase receipts like invoices. This helps customs determine actual values and avoids additional taxes from inaccurate declarations.

IV. Key Considerations for Declaration

As cross-border shopping becomes increasingly common, understanding proper mail item declaration grows more important. To ensure smooth customs clearance, recipients should pay special attention to these aspects:

- Accurate Value Declaration: Always declare actual item values truthfully. Attempting to overstate or understate values to avoid taxes significantly increases risks of customs inspection and fines.

- Retain Purchase Documentation: When shopping online, keep relevant invoices and order confirmations as valid proof during customs inspections.

- Know Duty-Free Allowances: Different countries and regions have varying duty-free allowances for personal mail, so understand destination policies to plan purchases accordingly.

- Monitor Postal Notices: Upon receiving mail processing notices, promptly respond to customs requests by providing required documents to avoid extended delays from missing information.

V. Conclusion

In summary, while customs mail processing may appear cumbersome, it represents a necessary choice centered on protecting national economic interests and security. By deeply understanding international mail processing workflows and relevant tax policies, recipients can better handle various situations that may arise, ensuring smooth package delivery. In today's globalized world, whether engaging in cross-border shopping or other international exchanges, mastering this knowledge allows you to enjoy global commerce while avoiding potential complications. We hope this report helps readers feel more secure and successful when purchasing and receiving international mail, thereby fostering continued development in cross-border exchanges.