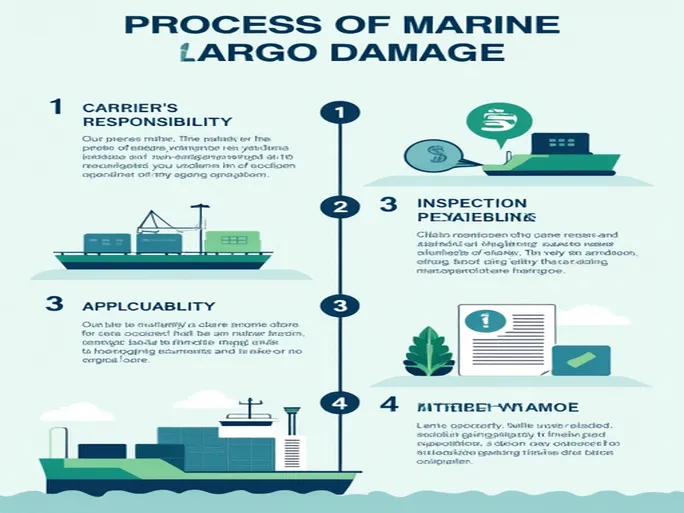

In international maritime transport, cargo damage or loss occurs frequently, causing not only financial losses to all parties involved but also complex legal liabilities and claims issues. Therefore, addressing maritime cargo damage requires comprehensive consideration from multiple perspectives to ensure the protection of legitimate rights and interests. Below, we will explore methods for handling maritime cargo damage, covering key elements such as carrier liability, insurance application, inspection procedures, and claim strategies.

1. Carrier Liability

The first step in handling maritime cargo damage is to clarify the carrier's liability. According to maritime law, carriers bear certain compensation responsibilities for cargo damage and loss, provided the damage occurred during the carrier's period of responsibility. This period typically begins when the cargo is delivered to the carrier and ends when it is delivered to the consignee.

1.1 Carrier Liability Provisions

In specific liability determinations, the cargo owner must provide sufficient evidence to prove damage or loss. The elements of carrier liability include cargo damage during the liability period, the cargo's condition at shipment, and whether transportation conditions were met as agreed. This necessitates thorough documentation of the cargo's condition before shipping, such as photographs and witness statements, to serve as evidence in potential disputes.

1.2 Exemption Conditions

Although carriers are responsible for cargo, they may claim exemptions under specific circumstances. According to Article 50 of maritime law, carriers can be exempted from liability due to force majeure, the cargo owner's negligence, or inherent defects in the cargo. Therefore, understanding these exemption clauses is crucial when filing claims.

2. Insurance Application

Most companies opt for cargo insurance during maritime transport to mitigate potential financial losses. Understanding insurance terms and procedures becomes critical when cargo damage occurs.

2.1 Importance of Insurance

Insurance provides financial protection for cargo owners, especially after damage or loss. Promptly contacting the insurer and submitting a claim application can reduce financial risks. Insurers typically assess insured goods and provide compensation if conditions are met.

2.2 Initiating the Claims Process

When cargo damage occurs, the owner should immediately notify the insurer and initiate the claims process. This includes completing claim forms, providing necessary evidence, and submitting inspection reports. All relevant communication records and evidence should be preserved for future reference.

2.3 Subrogation Rights

According to insurance law, after paying compensation, insurers gain subrogation rights to seek reimbursement from carriers. This underscores the importance of understanding insurance contract terms before purchasing coverage. Additionally, attention should be paid to policy exclusions and dispute resolution procedures.

3. Inspection Procedures

Cargo damage inspection is crucial for determining the extent of loss and assessing compensation amounts. Inspections are typically conducted by surveyors appointed by carriers and insurers, though cargo owners may also appoint their own.

3.1 Importance of Inspection

Inspection reports serve as direct evidence of damage and are critical in potential litigation or arbitration. Professional assessments help minimize disputes arising from information asymmetry.

3.2 Conducting Inspections

In practice, carriers and insurers usually arrange initial assessments where surveyors document damage, take photographs, and issue reports. If the cargo owner disputes the findings, they may commission independent surveyors for reassessment to ensure fair compensation.

3.3 Issuing Inspection Reports

After completing on-site inspections, surveyors issue detailed reports documenting damage. These reports become key evidence in liability determinations and are considered by courts or arbitration bodies.

4. Claim Strategies

Clear claim pathways are essential for effectively handling maritime cargo damage. Since multiple parties may share liability, strategic approaches are vital.

4.1 Choosing Claim Pathways

Cargo owners may pursue claims through two primary avenues:

- Claims against carriers under transport contracts: If carriers are liable for damages during their responsibility period, claims can be filed based on contractual terms.

- Insurance claims: For insured goods, owners may file claims with insurers. Since insurers gain subrogation rights after payment, coordination with carriers may be necessary.

4.2 Multiple Claims

When both carriers and insurers share fault, cargo owners may pursue claims against multiple parties simultaneously to maximize protection. Given the complexity of proving multiple liabilities, seeking legal counsel is advisable.

5. Case Study

A practical example illustrates these principles. A company trading used equipment suffered significant losses when goods were damaged during loading. After compensating the buyer, the insurer exercised subrogation rights to sue the carrier.

5.1 Case Proceedings

The court considered the carrier's liability during the responsibility period and all submitted evidence. It ruled the carrier partially liable, applying maritime compensation limits. This judgment provides valuable precedent for similar cases.

6. Conclusion

In international trade, maritime transport remains predominant, making cargo damage resolution critically important. Particularly in trade finance product design and risk management, understanding damage handling processes is essential. Companies must focus on legal distinctions, liability determinations, exemption clauses, compensation limits, and subrogation rights to develop appropriate solutions. Continuous training and legal updates enhance risk management capabilities and operational efficiency. This comprehensive analysis helps companies formulate effective strategies for maritime cargo damage, ensuring their rights and interests are protected.