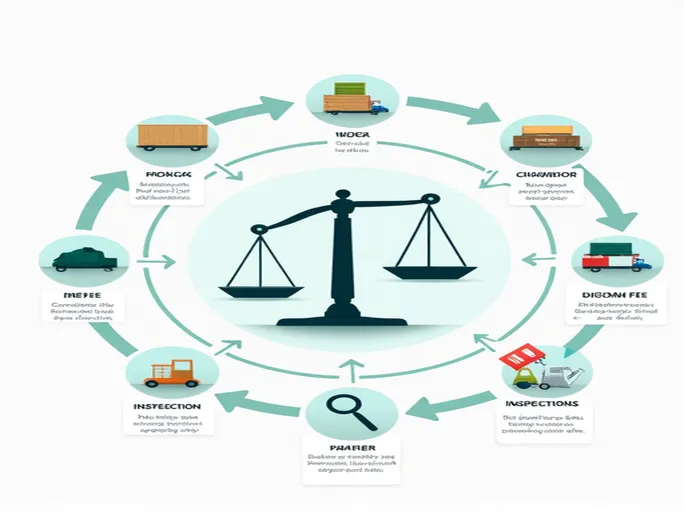

In international trade, customs clearance is an essential process that every importer and exporter must navigate. With the acceleration of global trade, understanding the various fees involved in the clearance process has become crucial for businesses and individuals to complete imports successfully. This article provides an in-depth analysis of import customs clearance fees from multiple perspectives to help you better manage the process, ensure smooth cargo clearance, and minimize unnecessary expenses and delays.

1. Customs Clearance Fee

The customs clearance fee is an unavoidable expense for imported goods, typically charged at 150 yuan per declaration. Following updates to the customs declaration form format by the General Administration of Customs, the form can now accommodate up to 50 product items. For declarations with 8 items or fewer, the standard fee remains 150 yuan. However, additional pages are required for declarations exceeding 8 items, with each extra page typically costing 50 yuan. Therefore, proper planning of product categories and quantities can help control this expense.

2. Customs Inspection Fee

Customs inspection is a vital measure to ensure border security, and the associated inspection fees are collected by customs brokers or warehouses, usually around 100 yuan. This fee covers the cost of customs brokers traveling to inspection sites to assist with the process and verify that declared goods match their actual condition. In certain cases, such as when goods require special inspection (e.g., for restricted items or suspected contraband), inspection fees may increase.

3. Wood Inspection Fee

With growing international emphasis on biosecurity, inspection of wooden packaging has become an essential part of import clearance. Wood inspection fees typically include charges for pallets and wooden cases: approximately 30 yuan per pallet and 20 yuan per wooden case, plus 0.08% of the goods' value. Businesses should consider whether to use wooden packaging materials to estimate these costs in advance.

4. Fumigation Fee

Fumigation is increasingly common in international trade to prevent biological contamination from wooden packaging and goods themselves. Fumigation costs vary significantly by container size: generally 300 yuan for volumes below 10 cubic meters (CBM), 600 yuan for 20-foot containers, and 1,200 yuan for 40-foot containers. Additionally, each extra CBM beyond 10 incurs an additional 20 yuan. This fee covers not just fumigation but also the service costs associated with meeting these special requirements.

5. Inspection Fee

Goods subject to inspection and quarantine procedures require an inspection fee, typically around 80 yuan per declaration. The exact amount may vary by city, product category, and customs broker's pricing. Inspection serves both safety purposes and government quality control requirements for imported goods, making it an essential step.

6. Terminal Handling Charge

Terminal handling charges relate to cargo storage and vary by port. Businesses should research specific charges at different locations in advance to avoid unexpected costs during clearance. During peak seasons, terminal fees may increase, so optimizing storage duration can help reduce this expense.

7. Forklift Fee

For palletized or oversized cargo clearance, forklift fees are necessary, typically around 50 yuan per item. This covers the cost of loading and unloading goods with forklifts. To control these costs, businesses should consider packaging methods and transportation routes when purchasing goods.

8. Bill of Lading Amendment Fee

In import/export trade, bill of lading amendments sometimes become necessary to accommodate different transportation needs. Amendment fees generally range between 200-300 yuan, varying by transport mode (e.g., air vs. sea). To avoid unnecessary costs, businesses should ensure bill accuracy before shipping to minimize amendments.

9. Handling Fee

Handling fees depend on cargo type and weight. Standard rates are approximately 0.6 yuan per kilogram. For goods exceeding 100kg, additional overweight fees of about 50 yuan apply, while hazardous materials cost significantly more at around 650 yuan per declaration. Understanding handling fee structures helps businesses better control overall logistics costs.

10. Detention Fee

Container detention fees are another critical consideration, typically 1,200 yuan per day for 20-foot containers and 1,600 yuan for 40-foot containers. If goods aren't loaded promptly upon arrival, businesses face unnecessary detention charges. Proper scheduling of transportation and loading times is therefore essential.

11. Lifting Fee

Lifting fees cover transferring containers from yards to trucks: approximately 200 yuan for 20-foot containers and 300 yuan for 40-foot containers. Special lifting requirements may substantially increase these costs. Businesses should include detailed lifting method and cost estimates in logistics planning to avoid budget shortfalls.

12. Port Charges

Port charges vary by shipping company and should be clearly indicated on bills of lading. Businesses should research different carriers' port charge structures when selecting shipping services to facilitate accurate budgeting.

13. Yard Storage Fee

Similarly, yard storage fees depend on shipping companies and invoices. Businesses should obtain detailed information to determine actual costs during implementation. Since these fees relate directly to logistics, comprehensive evaluation before clearance is crucial.

14. Transit Fee

Goods requiring transit procedures incur fees similar to customs clearance, typically 100 yuan per declaration. Transit may become a focus during clearance due to logistics arrangements or cargo monitoring. Without prior understanding of transit fees and application processes, overall clearance timelines may be affected.

15. Supervised Trucking Fee

For shipments requiring supervised transport, costs exceed regular trucking rates—for example, for Chongqing to Chengdu routes. These higher fees reflect clearance complexity and supervision requirements. Proper planning and transport mode selection can help balance compliance with cost efficiency.

16. Delivery Fee

Pickup or delivery services typically cost around 80 yuan, with variations possible by destination and special requirements. To ensure smooth delivery, businesses should contact service providers in advance to understand relevant fees and considerations.

Conclusion

In summary, various fees during import clearance collectively determine total trade costs. To ensure smooth clearance, businesses must understand and evaluate these fees in advance for proper budget planning and cost reduction. This not only improves economic efficiency but also enhances international trade fluidity. As globalization deepens, accurate calculation and proper arrangement of clearance fees will become key success factors for import/export businesses. When communicating with customs brokers, inquire in detail about each fee component to obtain accurate, transparent service quotes and select optimal clearance solutions for your goods.