In today's complex and rapidly evolving international trade landscape, customs clearance remains a critical process that every importer must master. For newcomers, understanding the various fees and procedures can be particularly daunting. This guide breaks down the key expenses you may encounter during import customs clearance, helping you navigate the process with confidence.

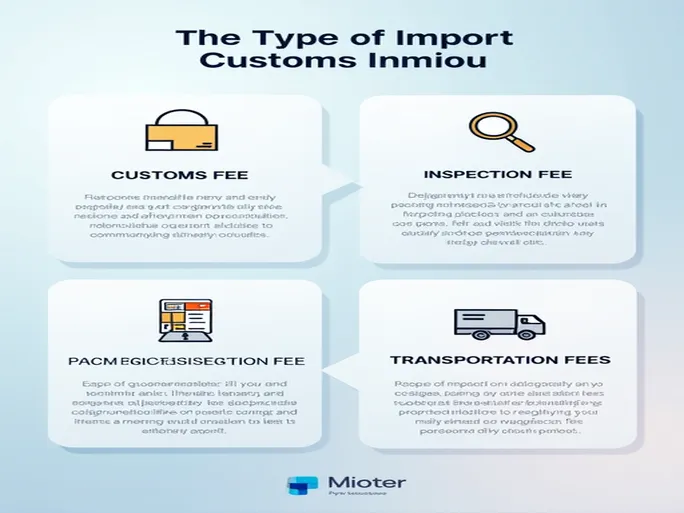

Customs Clearance Fees

The most fundamental expense is the customs clearance fee, typically charged per declaration at a standard rate of ¥150. Recent reforms by China's General Administration of Customs have introduced updated declaration forms that now accommodate up to 8 items per page—an increase from the previous 5-item limit. This change improves efficiency but comes with additional costs for larger shipments:

- ¥50 per additional page when exceeding 8 items

- Maximum of 50 items per declaration (requires splitting declarations beyond this limit)

Inspection-Related Charges

Customs inspection fees typically cost around ¥100 per examination, though this may vary depending on the goods and inspection requirements. These fees are usually collected by warehouses or customs brokers who assist during the process.

For shipments with wooden packaging, mandatory inspection fees apply:

- ¥30 per wooden pallet

- ¥20 per wooden crate

- Additional 0.08% of goods value

Fumigation fees represent another critical expense:

- Standard fee: ¥300 for smaller shipments

- ¥20 per additional cubic meter

- Container rates: ¥600 (20ft) or ¥1,200 (40ft)

Logistics and Handling Fees

Various operational charges emerge during clearance:

- Inspection fee: ¥80 per declaration

- Forklift service: ¥50 per item

- Document exchange: ¥200-300

- Demurrage charges: ¥1,200/day (20ft) or ¥1,600/day (40ft)

- Loading fees: ¥200 (20ft) or ¥300 (40ft)

Port and terminal fees vary by shipping company, while transshipment fees typically cost ¥100 per declaration. Transportation costs for supervised shipments can be substantial—for example, ¥4,900 for a 40ft container from Chongqing to Chengdu.

Strategic Cost Management

Delivery charges typically start around ¥80 but vary based on shipment specifics. Importers should note that not all fees apply to every shipment—costs depend on factors like:

- Nature of goods

- Shipment volume

- Transport method

- Packaging materials

Proactive planning and clear contractual agreements about fee structures can prevent budget overruns. Always verify costs with your customs broker and maintain detailed expense tracking throughout the clearance process.

By understanding these fee structures and planning accordingly, importers can optimize their customs clearance operations, ensuring smoother international trade transactions while maintaining cost control.