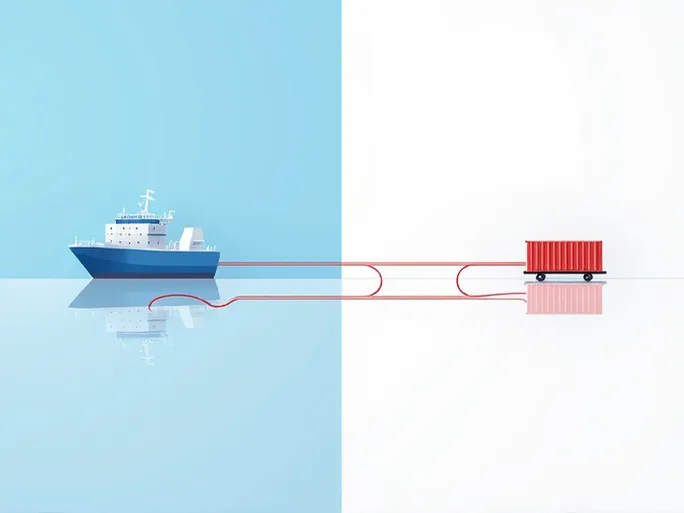

Imagine goods crossing oceans, nearing their destination, only to face customs delays or incur excessive fees due to a single document—the bill of lading. In international trade, the choice between a Master Bill of Lading (MBL) and a House Bill of Lading (HBL) directly impacts cost control and risk management. This comprehensive guide examines these critical shipping documents to help businesses make informed decisions.

Understanding Master and House Bills of Lading

A Master Bill of Lading (MBL) is issued directly by the shipping carrier and serves as the primary proof of cargo ownership. It may be issued to either the cargo owner or their freight forwarder. In contrast, a House Bill of Lading (HBL) comes from a Non-Vessel Operating Common Carrier (NVOCC)-licensed freight forwarder, typically issued directly to shippers. HBLs dominate export transactions, particularly in European and American markets.

Key Differences at a Glance

| Feature | Master Bill of Lading (MBL) | House Bill of Lading (HBL) |

|---|---|---|

| Issuing Party | Shipping carrier | NVOCC-licensed freight forwarder |

| Document Type | Primary title document | Secondary title document |

| Document Release | Direct release from carrier's agent with fixed fees | Requires intermediate exchange at forwarder's office with variable fees |

| Parties Listed |

When issued to shipper: exporter as SHIPPER, consignee per instructions

When issued to forwarder: forwarder as SHIPPER, their agent as CONSIGNEE |

Actual exporter as SHIPPER, consignee typically "TO ORDER" per letter of credit |

| Cargo Compatibility | Full container loads (FCL) and less-than-container loads (LCL) | FCL and LCL (LCL shipments require HBL) |

| Customs Integration | B/L number included in customs manifest system | B/L number excluded from customs manifest system |

Selecting the Appropriate Bill of Lading

Consider these factors when choosing between MBL and HBL:

- Payment Processing: Both documents serve equally as negotiation instruments for banks.

- Risk Management: MBL provides direct cargo control if the forwarder becomes insolvent.

- Clearance Speed: MBL offers streamlined document release at destination ports.

- Cost Considerations: HBL document exchange often involves unpredictable fees.

- Shipment Type: LCL shipments necessitate HBL usage.

Strategic Advantages of House Bills

While MBLs provide superior cargo control, HBLs offer unique operational benefits:

- FOB Shipments: Facilitates freight collect arrangements with flexible pricing.

- Door-to-Door Services: Enables comprehensive delivery solutions including customs clearance.

- Triangular Trade: Supports complex multi-party transactions through document conversion.

- Consolidated Shipments: Allows multiple LCL shipments under a single MBL.

- Date Adjustments: Permits backdated issuance under letter of credit terms (with indemnity).

Operational Considerations

Businesses should:

- Verify forwarder's NVOCC licensing status

- Clarify all destination port charges in advance

- Review all document terms and conditions

- Maintain complete shipping documentation

Practical Examples

Success Scenario: A textile exporter partnered with a reputable forwarder using HBL. The forwarder's destination expertise ensured prompt clearance and delivery, strengthening client relationships.

Cautionary Tale: An electronics manufacturer selected an unqualified forwarder to reduce costs. The resulting documentation issues caused port detention and substantial demurrage fees.

Conclusion

The MBL versus HBL decision requires careful evaluation of transaction specifics, risk tolerance, and cost objectives. Understanding these documents' nuances empowers businesses to optimize their international shipping strategies. Remember—these aren't mere paperwork, but critical instruments protecting cargo ownership throughout global supply chains.