When sending money internationally, selecting the correct SWIFT/BIC code is crucial. However, for many, these codes remain a mystery—particularly their exact meaning and proper usage. Take, for example, the SWIFT/BIC code NDEAFIHHHAM for NORDEA BANK ABP. How can one verify its accuracy and validity?

Understanding SWIFT/BIC Codes

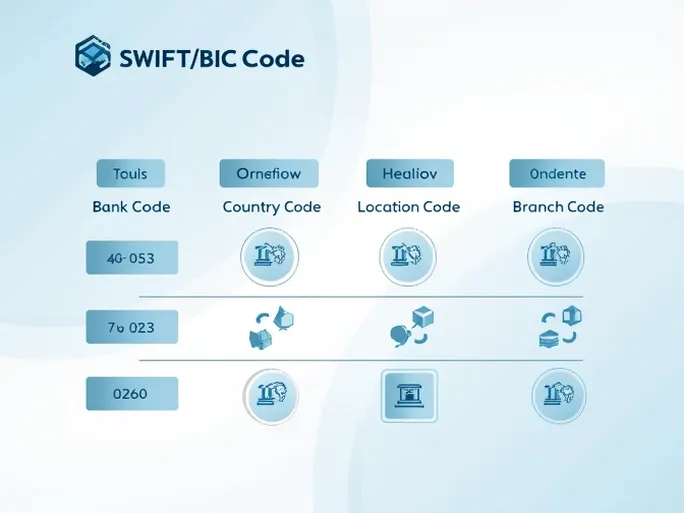

A SWIFT/BIC code, typically consisting of 8 to 11 characters, uniquely identifies a specific bank and its branch. The structure is as follows:

- Bank Code (4 characters): Identifies the financial institution (e.g., NDEA for NORDEA BANK ABP).

- Country Code (2 characters): Indicates the bank's location (e.g., FI for Finland).

- Location Code (2 characters): Specifies the bank's headquarters (e.g., HH ).

- Branch Code (3 characters, optional): Identifies a specific branch. A code ending in XXX typically refers to the bank's primary office.

Decoding NORDEA BANK ABP's SWIFT/BIC: NDEAFIHHHAM

- SWIFT/BIC Code: NDEAFIHHHAM

- Bank Code: NDEA

- Country Code: FI (Finland)

- Location Code: HH

- Branch Code: HAM

- Bank Name: NORDEA BANK ABP

- Address: Satamaradankatu 5

- City: Helsinki

Key Verification Steps Before Transferring Funds

To avoid delays or failed transactions, always confirm the following:

- Bank Name: Ensure the recipient’s bank name matches the SWIFT code provided.

- Branch Details: If using a branch-specific code, verify it aligns with the recipient’s branch.

- Country: Double-check that the SWIFT code corresponds to the correct country where the recipient’s bank operates.

Optimizing International Transfers

Specialized money transfer services often provide competitive exchange rates, lower fees, and faster processing times compared to traditional banks. When selecting a provider, comparing these factors can lead to significant savings and efficiency.

Ultimately, combining accurate SWIFT/BIC codes with a reliable transfer service ensures seamless international transactions.