In today's global trade landscape, Harmonized System (HS) codes for food products play a pivotal role, particularly for importing and exporting nations. The specific code 0207332000 serves as the international identifier for frozen whole geese, enabling precise tracking and management of this commodity. This classification carries significant implications for international trade regulations and taxation policies.

Classification and Market Position

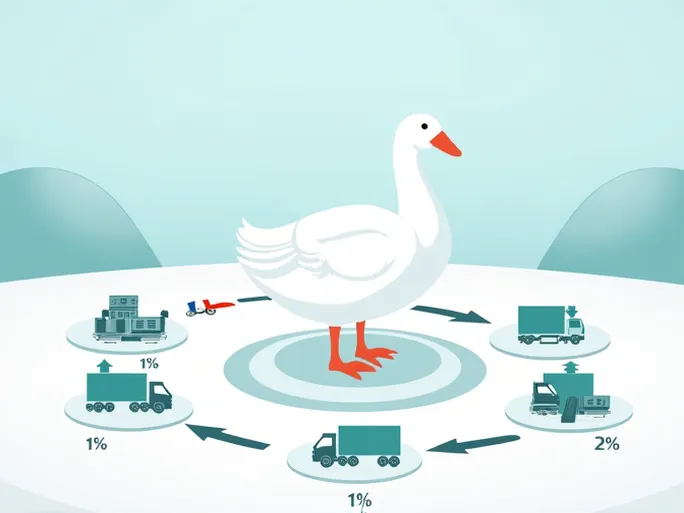

HS code 0207332000 exclusively designates frozen whole geese, categorized under Chapter 1 (Live Animals and Animal Products), specifically within Section 0207 (Meat and Edible Meat Offal). Frozen goose has emerged as a specialty meat product gaining popularity in domestic markets while experiencing growing export volumes internationally. This upward trend makes understanding its tax implications, declaration requirements, and regulatory conditions increasingly important for trade participants.

Taxation Analysis

Current tax records indicate several favorable conditions for frozen whole goose trade under HS code 0207332000:

- No export tax rate applies

- No export tax rebate rate exists

- Most-favored-nation (MFN) import tax rate remains unset

- General import tax rate similarly undeclared

These conditions create a tax-efficient environment for international transactions, potentially enhancing the competitiveness of frozen goose products in global markets.

Declaration Requirements and Regulatory Conditions

The current regulatory framework presents advantageous conditions for frozen goose trade:

- No special declaration elements required

- No mandatory inspection and quarantine requirements

This streamlined approach reduces trade complexity and operational costs, facilitating smoother international transactions in today's fast-paced market environment.

Additional Considerations

While the CIQ code and various agreement tax rate information remain unspecified for HS code 0207332000, market participants should monitor product-specific policy developments to anticipate potential trade friction. It's worth noting that the commodity update status was last verified as effective before December 30, 2018, requiring businesses to verify the current validity of this information.

The frozen goose trade under HS code 0207332000 presents unique opportunities in international commerce. Market participants must maintain current knowledge of classification details and associated tax implications to ensure compliance and maintain competitive positioning in global trade.