Dried Gracilaria, a valuable marine algae species, has gained increasing attention in global trade in recent years. Classified under HS code 1212207100, this commodity has become an important identifier for customs statistics, enabling more efficient handling of taxation and regulatory matters during import and export processes.

Classification and Tariff Policies

According to the latest customs data, Gracilaria falls under the plant products category with HS code 1212207100. This classification includes fresh, chilled, frozen, or dried seaweed and other algae, with special emphasis on products whether or not they have been ground.

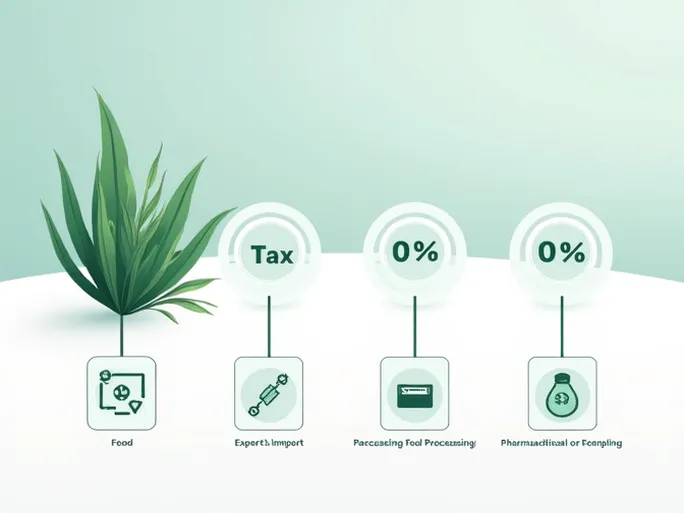

The commodity enjoys several favorable tariff conditions:

- Zero export tax rate

- Zero export tax rebate rate

- Zero provisional export tax rate

- Exemption from value-added tax on exports

For imports, while the most-favored-nation tax rate and consumption tax rate are both zero, the product is not subject to ordinary tax rates or provisional tax rates. These favorable conditions significantly enhance Gracilaria's competitiveness in international markets.

Regulatory Advantages

Gracilaria benefits from streamlined regulatory processes with no special restrictions or quarantine requirements. This regulatory simplicity facilitates smooth market entry, providing more options for related industries and consumers.

As a plant product, Gracilaria boasts remarkable nutritional value and economic utility. Its applications span multiple industries including food processing and pharmaceutical research.

Market Outlook

With growing awareness of Gracilaria's commercial potential among businesses, market demand is expected to continue rising in the coming years. For traders looking to enter this sector, understanding the HS code classification and related tax policies has become increasingly important.