In international commerce, comprehensive knowledge of Harmonized System (HS) codes and corresponding tariff rates proves essential, particularly for high-volume export products. The case of HS code 9617001910 offers valuable insights into classification specifics and trade policies affecting vacuum-insulated containers.

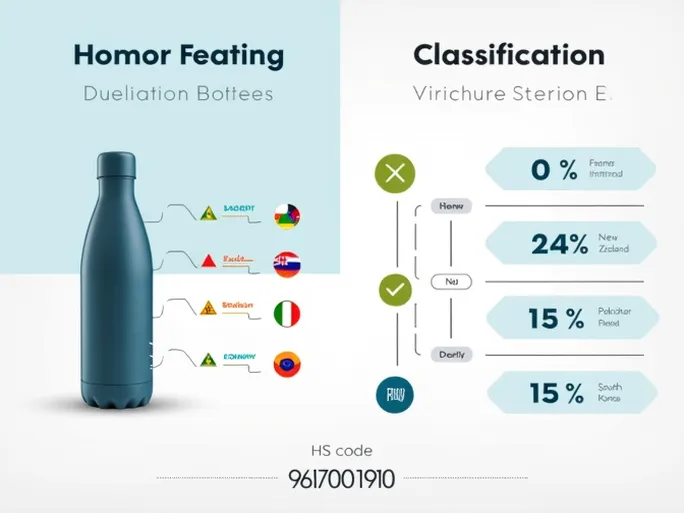

The 10-digit code 9617001910 precisely identifies vacuum flasks as classified under Chapter 96 for miscellaneous manufactured articles, specifically within heading 9617 covering vacuum vessels. This classification notably excludes products containing glass inner containers, reflecting precise technical differentiation in customs nomenclature.

Current Chinese customs data reveals favorable trade conditions for these products. Exporters benefit from a 0% export duty rate, complemented by potential tax rebates that enhance international competitiveness. The Most-Favored-Nation (MFN) tariff structure demonstrates significant regional variation, with ASEAN member states, New Zealand, and Peru applying zero tariffs, while Pakistan maintains a 24% duty and Korea implements a 15.6% rate.

The absence of special inspection requirements or regulatory controls further streamlines cross-border transactions involving these products. This regulatory simplicity reduces administrative burdens and facilitates efficient trade operations.

For commercial enterprises engaged in vacuum flask trade, mastery of HS code 9617001910's tariff implications and policy framework represents a strategic advantage. Accurate classification and tariff awareness enable optimized pricing strategies, improved market positioning, and enhanced compliance in diverse international markets. Such knowledge proves particularly valuable when navigating complex trade agreements and preferential tariff arrangements.