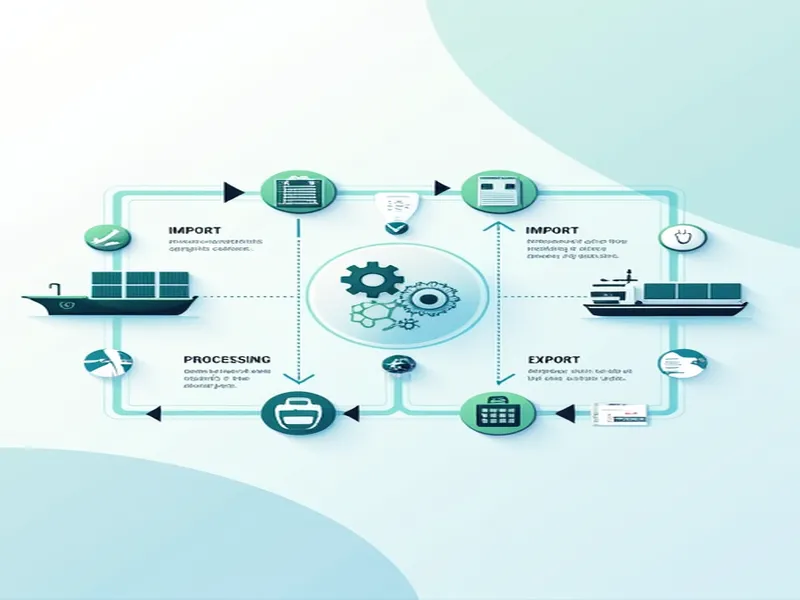

Re-export in processing trade refers to the process of importing goods, processing them, and then exporting them again. When conducting re-exports, companies must comply with specific customs management policies and prepare a series of declaration documents to ensure legal compliance. Below are the main required documents and considerations for re-export:

Key Documents for Re-Export

- Export Customs Declaration Form: This is one of the most important documents in the re-export process. It must be filled out with accurate information that matches the actual shipment details.

- Invoice and Packing List: These documents contain basic information about the goods, as well as key details such as transaction amounts and quantities, which help customs verify the shipment.

- Situation Explanation: This document should provide a detailed explanation of the reasons for re-export and the specific processing procedures, enabling customs to understand the flow of goods.

- Return Agreement: This agreement confirms the legal responsibilities involved in the re-export process, protecting the rights of both the company and customs.

- Original Import Customs Declaration Form: The previous import declaration form must be provided to demonstrate the legality and traceability of the goods.

- Power of Attorney: Companies must provide a letter of authorization to the customs broker, allowing them to represent the company in customs declarations during re-export.

When completing these procedures, special attention should be paid to authorizing the customs broker to handle the processing trade manual. If it involves a "Jin Er" manual, ensure that the export bonded verification list is properly prepared. Such preparations and compliant operations can effectively avoid potential issues during customs re-export inspections.

Customs Recordation and Brand Export

When dealing with customs recordation for brand exports, it is essential to understand the similarities between brands and differences in product categories. During this process, companies can assess whether the export meets requirements based on brand similarity and category distinctions. If the brand is the same but the specific product category differs, exports can generally proceed smoothly.

In cases where the brand is the same and the product categories are similar, if the manufacturer has already completed intellectual property recordation in the customs system, more cautious procedures should be followed. For export companies, recommended practices include:

- Providing detailed export goods information, including the exporter's name, product name, HS code, quantity, port of departure, destination country, and expected export time. This information helps customs more accurately determine compliance.

- Proactively contacting the intellectual property management team of the brand to confirm relevant details, reducing risks related to intellectual property disputes. This approach ensures smoother brand exports, protecting both the brand's legal rights and the company's business operations.

New Customs Declaration Form and Inspection Requirements

As customs policies continue to evolve, the requirements for declaration forms have also changed. Starting from August 1, 2018, commodity codes were officially extended from 10 digits to 13 digits. The first 10 digits remain the customs-specific code, while the last three digits are designated as inspection codes. This adjustment not only improves customs query efficiency but also enhances the precision of commodity management and monitoring.

When filling out the new declaration form, companies must ensure that all HS codes are 13 digits to avoid delays caused by inaccurate coding. It is recommended to verify and adjust codes using online tools before submission. The provided query link facilitates effective information management, ensuring products pass through customs smoothly during import and export processes.

By understanding the requirements for processing trade, customs recordation, and the new declaration form, companies can enhance their compliance in international trade while strengthening their brand's market competitiveness and export capabilities. Mastering these key details not only improves operational efficiency but also minimizes risks in the complex international trade environment, creating greater profit opportunities.