I. Overview of Temporary Import Goods Customs Services

Temporary import goods refer to items permitted to enter Chinese territory for a specific period under the "Administrative Measures of the People's Republic of China on Temporary Inward and Outward Goods." Customs supervision of such goods is classified under the "2600" regulatory code.

1. Relevant Laws and Regulations

According to customs regulations, temporary import goods must meet specific conditions, including:

- Performance and competition items used in cultural and sports exchange activities

- Equipment for news reporting or film/TV program production

- Instruments and equipment required for scientific research, education, and medical activities

- Transport vehicles or special-purpose vehicles

Note: Certain cases like exhibition items or goods for repair don't qualify for temporary import/export supervision.

2. Customs Approval Process

To ensure compliance, importers must submit a "Temporary Import/Export Goods Confirmation Application" to the supervising customs office before declaration. Customs conducts a three-tier review to verify compliance. Upon approval, they issue a "Temporary Import/Export Goods Review Confirmation Certificate," which must be presented during import inspection.

3. Extension Approval for Temporary Import Goods

Temporary import goods typically must be re-exported within six months. For special circumstances requiring extension, importers must apply to the supervising customs office and complete a "Goods Temporary Import/Export Extension Application Form." Extensions are limited to three applications, each not exceeding six months.

4. Active Case Closure

After re-exporting goods, consignees must complete closure procedures with the supervising customs office. Failure to do so may result in administrative penalties.

II. Target Clients

This service applies to organizations requiring temporary import goods and international freight forwarding companies.

III. Client Needs and Pain Points

- Purchase Retention Requirements: For goods to be retained, apply within the specified period and provide documents like medical device registration certificates.

- Display/Testing Completion Deadlines: Prepare extension applications one month in advance if unable to complete within the import period.

- Goods Deposit Tax Rate: Deposits typically equal taxes paid in regular trade imports. Specific tax codes can calculate exact amounts.

- Customs Usage Tax Calculation: Based on a 60-month period from import release date to tax payment deadline.

IV. Dashun Customs Clearance Service Advantages

- Free consultation services, including document review, submission, deposit refund, and case closure.

- Experienced clearance team with streamlined processes for efficient service.

- 24/7 customer support for emergency clearance situations.

- Comprehensive logistics and freight forwarding resources for one-stop solutions.

V. Service Process

1. Required Documents for Customs Approval

Include "Temporary Import/Export Application," "Goods List," "Record Form," and "Goods Description" in duplicate copies:

- Temporary Import/Export Goods Confirmation Application

- Temporary Import/Export Goods List

- Goods Temporary Import/Export Description

Note: All documents must be stamped and complete.

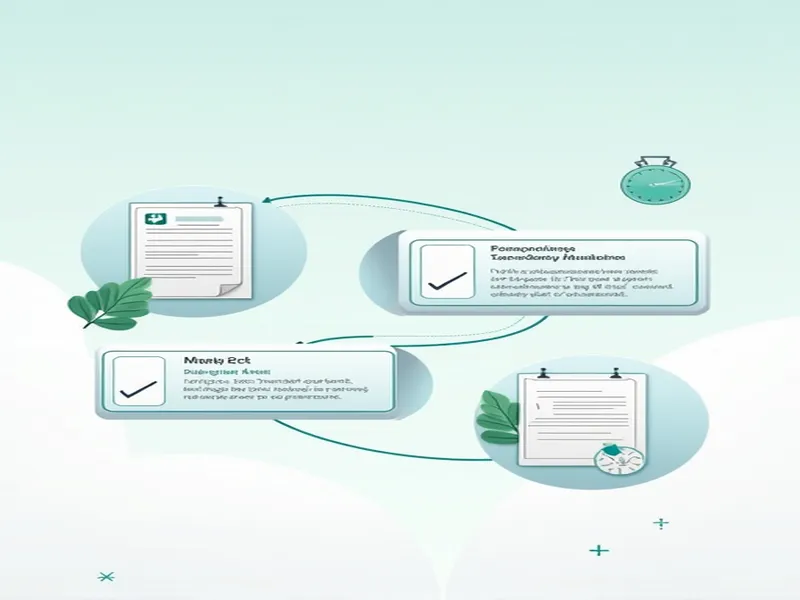

2. Service Process

Initial services include client document review, organization, customs approval, and deposit payment. Mid-phase involves extension and retention applications before deposit expiration. Final phase covers case closure and deposit refund procedures.

3. Time Requirements for Each Step

- Approval: 5-10 working days

- Port clearance: 3-5 working days

- Extension procedures: Apply 45 days in advance

VI. Important Notes and Recommendations

- Apply for customs approval early to avoid compliance risks from delays.

- Enhance communication between parties to minimize unnecessary costs.

- Adhere to the 6-month usage period requirement.

- Complete procedures promptly to prevent customs penalties.

VII. Business Consultation

For further inquiries, please contact our specialists via phone or email for detailed information.

This guide provides comprehensive understanding of temporary import goods clearance services. We welcome your consultation to select suitable services for smooth business operations.