Domestic Express Companies' Charging Standards and Service Features

This summary outlines the charging standards and service features of major express companies, assisting consumers in making informed choices about their delivery options.

Explore the latest technology development trends in the logistics industry and understand how innovative solutions drive industry transformation

This summary outlines the charging standards and service features of major express companies, assisting consumers in making informed choices about their delivery options.

This guideline aims to standardize the customs declaration for import and export goods, clarifying the filling requirements to enhance data quality. It includes requirements for pre-entry numbers, customs numbers, consignee and consignor information, and filling requirements for ports of entry and exit, ensuring compliance and transparency. Specific requirements for special circumstances are also included, with the intention of improving the efficiency and accuracy of import and export customs declarations.

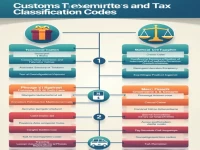

This article explores the importance of classifying HS (Harmonized System) customs codes and filling out declaration elements. Through practical declaration cases, it offers practical guidance for professionals in international trade and freight forwarding. The article analyzes the classification standards, purposes, and specific declaration methods for various goods, aiming to enhance customs declaration efficiency, reduce the risk of errors, and ensure the smooth progress of international trade.

This article focuses on the nature of customs exemptions, explaining their definition, classification, and relevant codes to assist businesses and individuals in understanding customs tax exemption policies better. It covers five categories of exemptions, including general taxation, statutory tax reductions, and specific tax exemptions, providing detailed analysis of their applicability and regulations. Through professional interpretation, the article aims to enhance the compliance capabilities and efficiency of businesses in international trade.

This article provides a detailed overview of the classification and codes for customs duties and exemptions, including general taxation, grants, and statutory reductions. It emphasizes the significance of exemption codes, particularly in customs automation and data statistics. Additionally, it analyzes various types of imported goods and their applicable policies, offering practical information for professionals in related industries.

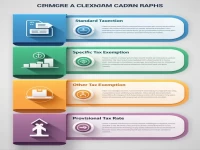

This article provides a detailed analysis of the classification and applicability of customs exemption codes. It covers various policies including general taxation, non-repayable aid, and specific regions such as bonded areas, offering a comprehensive understanding of tax management for imported and exported goods. The discussion delves into special policies for imported equipment related to technological upgrades, research projects, and disaster relief donations, aiming to assist enterprises in reducing costs and enhancing market competitiveness.

This article provides an in-depth analysis of the definition, classification, and specific application of customs tax exemption codes to help readers understand the structure and function of tax management. The system categorizes different taxation nature of import and export goods through clear coding, aiming to enhance the efficiency of customs enforcement and data management capabilities. It focuses on the relevant codes for general taxation and free aid goods, providing clear guidance for import and export operations.

This article delves into the nature codes for customs exemptions and their classification, definitions, and applicable scope, aiming to help readers understand the tax measures related to exemptions and reductions in international trade. It thoroughly covers statutory taxation, advanced exemption policies, and imports from specific regions, providing businesses with guidance for compliant and smooth import and export operations. Mastering this knowledge will enhance operational efficiency.

This article elaborates on the definition and application of customs duty exemption codes, categorizing them into five main types: statutory taxation, statutory duty exemptions, and more. It focuses on the codes for general taxation and duty-free aid imports and exports, including their applicable scopes. Furthermore, it emphasizes the importance of understanding customs policies for optimizing customs clearance processes and managing costs effectively.

This article comprehensively analyzes the classification and applicability of customs exemption codes, including general taxation, self-use materials, provincial budgets, and national key projects. By providing a detailed introduction to different category codes, it offers import and export enterprises a foundational awareness of tax management and compliance in operations. Understanding these aspects can effectively enhance enterprise efficiency and ensure competitiveness in the global market.