In today's rapidly globalizing economy, the complexities of international trade continue to grow, particularly regarding customs classification of goods. Companies frequently face significant challenges when classifying bladed tools and their components. This article examines the classification of knives with cutting edges under Chapter 82 of China's Customs Import and Export Tariff.

Customs classification serves as a fundamental component of international trade, directly impacting import duties, tariffs, and related trade policies. Understanding precise product categorization within customs regulations is therefore essential. Heading 82.11 specifically addresses knives with cutting edges, with variations in classification based on structure and functionality.

Understanding Heading 82.11

According to China's Customs Import and Export Tariff, Heading 82.11 covers knives with cutting edges, whether or not serrated, excluding those classified under Heading 82.08. The classification criteria primarily consider the blade's edge structure and specific functional characteristics. This category provides essential tools for both daily life and various industries.

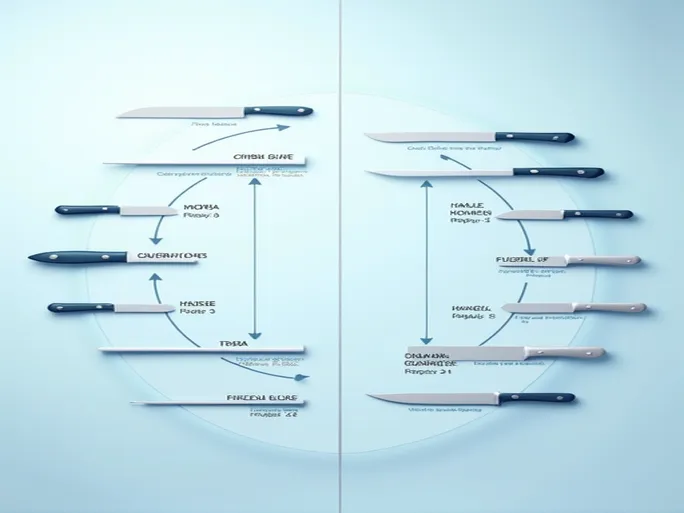

Heading 82.11 includes the following subcategories:

8211.1000

- Sets of articles

8211.9100

- Table knives with fixed blades

8211.9200

- Other knives with fixed blades

8211.9300

- Knives with non-fixed blades

8211.9400

- Blades

8211.9500

- Base metal knife handles

Detailed Classification Breakdown

8211.1000 - Sets of articles refers to combinations of multiple knives, such as kitchen knife sets that may include various types like chef's knives and paring knives. Classification focuses on the collective characteristics of the set rather than individual components.

8211.9100 and 8211.9200 both cover knives with fixed blades but differ by application. 8211.9100 specifically includes table knives designed for food service, typically featuring simple designs with smooth, fixed blades. 8211.9200 encompasses other fixed-blade knives where the blade and handle maintain a rigid connection, commonly used in culinary, craft, and industrial applications.

8211.9300 addresses knives with non-fixed blades, such as Swiss Army knives or electrician's knives. These designs allow blade folding or rotation, offering greater versatility for outdoor activities, repairs, and everyday use.

8211.9400 and 8211.9500 concern specific material compositions. Blades often incorporate advanced materials like wear-resistant alloys or carbon tool steel, while handles may use more economical base metals. Understanding these material differences aids both customs classification and practical tool performance.

Importance of Accurate Classification

Proper classification of cutting tools is critical for international trade compliance and supply chain efficiency. As market conditions evolve, companies must deepen their understanding of customs regulations to ensure smooth commercial operations and maintain regulatory compliance.