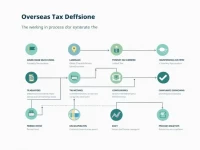

Tax Guide for Expats Planning Overseas Relocation

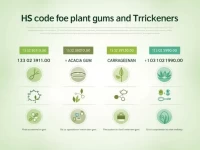

This article provides a tax guide for overseas individuals in the USA, UK, and Australia, helping readers grasp essential tax knowledge to ensure financial compliance and optimization while living abroad.