Small Sellers Boost Revenue with Overseas Warehouses Cut Platform Reliance

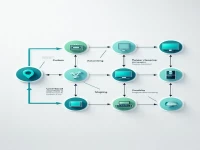

Facing peak season anxiety in cross-border e-commerce, how can small and medium-sized sellers break through? This article reveals the challenges of Amazon FBA and explores the advantages of overseas warehouses in multi-channel operations, cost reduction, handling emergencies, and improving logistics efficiency. Through refined management, SMEs can leverage overseas warehouses to achieve growth against the trend and earn millions annually. Overseas warehouses offer solutions for inventory management, faster delivery times, and greater control over the supply chain, allowing sellers to compete effectively in the global marketplace.