Amazon Ends FBA Inventory Prep Services Gives Sellers 5month Notice

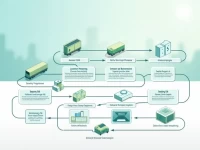

Amazon has announced that it will discontinue FBA storage and labeling services starting January 1, 2026. Sellers need to find suitable stocking partners within the next five months to prepare for the upcoming sales peak.